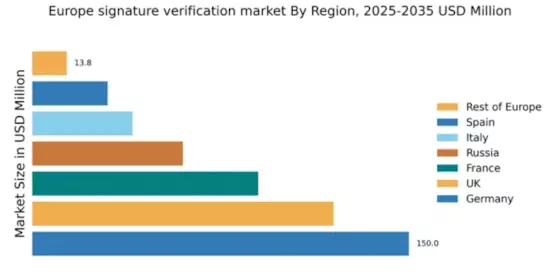

Germany : Strong Demand and Innovation Drive Growth

Key cities such as Berlin, Munich, and Frankfurt are pivotal in this market, hosting numerous tech startups and established firms. The competitive landscape features major players like IDnow and DocuSign, which are leveraging advanced technologies to offer innovative solutions. The local business environment is characterized by a strong emphasis on data protection and compliance, making it conducive for sectors like finance, healthcare, and legal services to adopt signature verification solutions. The growing trend of remote work also boosts demand for these services.

UK : Innovation and Compliance Drive Adoption

London, Manchester, and Birmingham are key markets, with a vibrant ecosystem of tech companies and startups. The competitive landscape includes major players like DocuSign and Adobe, which are well-established in the region. The local market dynamics are influenced by a strong focus on cybersecurity and data protection, creating a favorable environment for signature verification solutions. Industries such as real estate and e-commerce are increasingly adopting these technologies to streamline operations and enhance customer experience.

France : Regulatory Support Fuels Growth

Paris, Lyon, and Marseille are significant markets, with a mix of established firms and innovative startups. The competitive landscape features players like OneSpan and Signicat, which are gaining traction in the region. The local business environment is characterized by a strong focus on compliance and security, making it conducive for sectors such as healthcare and legal services to adopt signature verification solutions. The increasing trend of remote work and digital interactions further enhances demand for these technologies.

Russia : Market Expansion Amid Regulatory Changes

Moscow and St. Petersburg are key markets, with a burgeoning tech scene and increasing adoption of digital solutions. The competitive landscape includes local players and international firms like Kofax, which are expanding their presence. The local market dynamics are influenced by a focus on compliance with national regulations, creating opportunities for signature verification solutions in sectors such as finance and e-commerce. The growing trend of online services further boosts demand for these technologies.

Italy : Regulatory Frameworks Enhance Market Growth

Rome, Milan, and Turin are significant markets, with a mix of established firms and innovative startups. The competitive landscape features players like IDnow and Adobe, which are gaining traction in the region. The local business environment is characterized by a strong focus on compliance and security, making it conducive for sectors such as healthcare and legal services to adopt signature verification solutions. The increasing trend of remote work and digital interactions further enhances demand for these technologies.

Spain : Digital Transformation Drives Adoption

Madrid, Barcelona, and Valencia are key markets, with a vibrant ecosystem of tech companies and startups. The competitive landscape includes major players like DocuSign and OneSpan, which are well-established in the region. The local market dynamics are influenced by a strong focus on cybersecurity and data protection, creating a favorable environment for signature verification solutions. Industries such as real estate and e-commerce are increasingly adopting these technologies to streamline operations and enhance customer experience.

Rest of Europe : Varied Adoption Across Regions

Countries like Belgium, Netherlands, and Switzerland are notable markets within this sub-region, each with unique regulatory environments and business practices. The competitive landscape features a mix of local and international players, including Secured Signing and Notarize, which are expanding their reach. Local market dynamics are shaped by a focus on compliance and security, creating opportunities for signature verification solutions in various sectors. The growing trend of online services further boosts demand for these technologies.