Government Initiatives and Funding

Government support plays a vital role in shaping the shared mobility market in Europe. Various initiatives and funding programs are being implemented to promote shared mobility solutions as part of broader transportation strategies. In 2025, it is anticipated that European governments will allocate over €1 billion towards the development of shared mobility infrastructure and services. This funding is aimed at enhancing public transport integration, developing charging infrastructure for electric vehicles, and supporting innovative mobility projects. Additionally, regulatory frameworks are being established to facilitate the growth of shared mobility services, ensuring safety and reliability for users. Such government backing not only boosts consumer confidence but also encourages private sector investment, creating a conducive environment for the shared mobility market to flourish in Europe.

Urbanization and Population Density

The increasing urbanization in Europe is a pivotal driver for the shared mobility market. As cities expand and populations grow, the demand for efficient transportation solutions intensifies. Urban areas are becoming more congested, leading to a pressing need for alternatives to private vehicle ownership. In 2025, it is estimated that over 75% of the European population resides in urban areas, which significantly influences transportation dynamics. The shared mobility market is poised to benefit from this trend, as services like car-sharing and ride-hailing offer convenient solutions for urban dwellers. Moreover, the high cost of car ownership in densely populated cities further propels individuals towards shared mobility options, making them more appealing and accessible. This shift not only alleviates traffic congestion but also promotes sustainable urban living, thereby enhancing the overall attractiveness of shared mobility services.

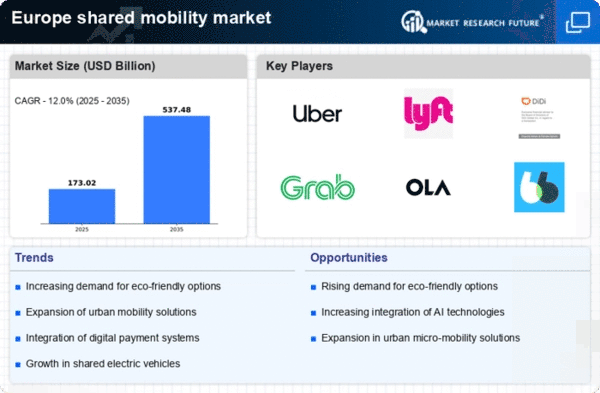

Environmental Concerns and Sustainability

Growing environmental awareness among European consumers is a crucial driver for the shared mobility market. As climate change becomes an increasingly pressing issue, individuals and governments alike are seeking sustainable transportation alternatives. The shared mobility market is likely to thrive as consumers prioritize eco-friendly options. In 2025, approximately 60% of Europeans express a preference for sustainable transport solutions, indicating a shift in consumer behavior. This trend is further supported by government initiatives aimed at reducing carbon emissions, such as the European Green Deal, which aims to make Europe climate-neutral by 2050. Consequently, shared mobility services that utilize electric vehicles or promote carpooling are gaining traction. The potential for reduced environmental impact, coupled with the economic benefits of shared mobility, positions this market as a key player in the transition towards a more sustainable transportation ecosystem.

Changing Consumer Preferences and Behavior

The evolving preferences of consumers are significantly influencing the shared mobility market in Europe. As lifestyles change, particularly among younger generations, there is a noticeable shift away from traditional car ownership towards shared mobility solutions. In 2025, surveys indicate that nearly 50% of millennials and Gen Z individuals prefer using shared mobility services over owning a vehicle. This trend is driven by factors such as cost savings, convenience, and a desire for flexibility in transportation options. Additionally, the rise of remote work and digital nomadism has led to a decreased need for personal vehicles, further propelling the demand for shared mobility services. As consumer behavior continues to evolve, the shared mobility market is likely to adapt and expand, offering diverse solutions that cater to the changing needs and preferences of the population.

Technological Advancements in Mobility Solutions

Technological innovations are transforming the shared mobility market in Europe. The integration of advanced technologies such as mobile applications, artificial intelligence, and data analytics is enhancing user experience and operational efficiency. In 2025, it is projected that over 40% of shared mobility users in Europe will rely on mobile apps for seamless access to services. These technologies facilitate real-time tracking, dynamic pricing, and improved vehicle management, making shared mobility options more attractive to consumers. Furthermore, the rise of autonomous vehicles could revolutionize the market, potentially reducing operational costs and increasing service availability. As technology continues to evolve, the shared mobility market is likely to see increased investment and growth, driven by the demand for innovative and efficient transportation solutions that cater to the needs of modern urban populations.