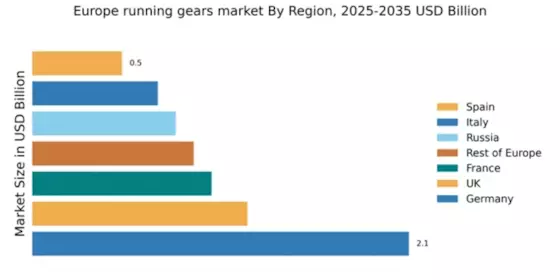

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Hamburg, where demand for high-performance running shoes is particularly strong. The competitive landscape features prominent players such as Adidas and Puma, both headquartered in Germany, alongside international brands like Nike and Asics. The local market is characterized by a blend of premium and budget offerings, catering to diverse consumer preferences. The growing trend of athleisure also influences the running gear sector, with increasing crossover into lifestyle apparel.

UK : Health Consciousness Fuels Market Growth

Key markets include London, Manchester, and Birmingham, where urban populations are increasingly engaged in running. The competitive landscape features major players like Nike and Adidas, alongside local brands. The market dynamics are shaped by a growing online retail presence, with e-commerce platforms gaining traction. Additionally, local running clubs and events foster community engagement, further driving demand for running gear. The athleisure trend continues to influence consumer choices, blending functionality with style.

France : Cultural Influences Shape Running Gear

Key markets include Paris, Lyon, and Marseille, where urban populations are increasingly active. The competitive landscape features both international brands like Nike and local players, creating a dynamic market environment. Local dynamics include a focus on quality and design, with consumers willing to invest in premium products. The running gear market is also influenced by seasonal events and marathons, which drive sales and brand visibility. The integration of technology in running gear is gaining traction, appealing to tech-savvy consumers.

Russia : Market Expansion Amid Challenges

Key markets include Moscow and St. Petersburg, where urban populations are more engaged in fitness activities. The competitive landscape features both international brands and local manufacturers, with a focus on affordability. Local market dynamics are influenced by economic conditions, affecting consumer spending power. The running gear sector is also impacted by seasonal events and community races, which help boost brand awareness. The growing trend of fitness apps and technology integration is beginning to shape consumer preferences.

Italy : Stylish Choices Drive Market Demand

Key markets include Milan, Rome, and Florence, where fashion-conscious consumers seek premium running gear. The competitive landscape features both international brands and local designers, creating a unique market environment. Local dynamics emphasize quality and design, with consumers willing to pay a premium for stylish products. The running gear market is also influenced by major sporting events and fashion weeks, which drive brand visibility and consumer interest. The integration of technology in running gear is becoming increasingly popular among consumers.

Spain : Fitness Trends Shape Consumer Choices

Key markets include Madrid and Barcelona, where urban populations are increasingly engaged in fitness activities. The competitive landscape features both international brands and local players, creating a diverse market environment. Local dynamics emphasize affordability and accessibility, with consumers seeking value for money. The running gear sector is also influenced by community events and races, which help boost brand visibility. The growing trend of fitness apps and technology integration is beginning to shape consumer preferences.

Rest of Europe : Varied Preferences Across Regions

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region, where urban populations are increasingly active. The competitive landscape features a mix of international brands and local players, creating a dynamic market environment. Local dynamics emphasize affordability and quality, with consumers seeking value for money. The running gear sector is also influenced by seasonal events and community races, which help boost brand visibility. The integration of technology in running gear is becoming increasingly popular among consumers.