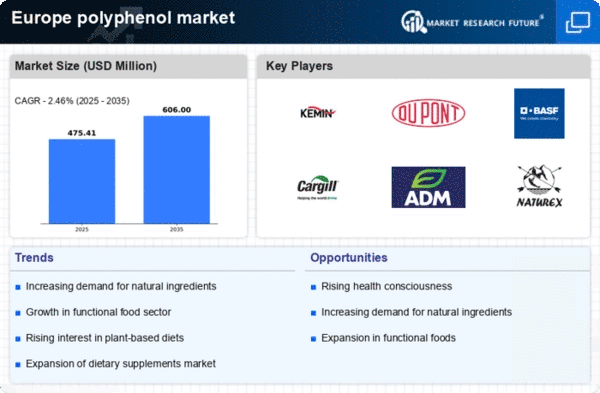

Growing Health Consciousness

The increasing awareness of health and wellness among consumers in Europe is driving the polyphenol market. As individuals become more informed about the benefits of polyphenols, such as their antioxidant properties and potential role in disease prevention, demand for polyphenol-rich products is likely to rise. This trend is reflected in the food and beverage sector, where products fortified with polyphenols are gaining traction. According to recent data, the market for functional foods, which often contain polyphenols, is projected to grow at a CAGR of approximately 8% over the next five years. This shift towards healthier lifestyles is expected to significantly impact the polyphenol market, as consumers increasingly seek natural ingredients that contribute to overall well-being.

Regulatory Support for Natural Products

In Europe, regulatory frameworks are increasingly favoring the use of natural ingredients, including polyphenols, in food and dietary supplements. The European Food Safety Authority (EFSA) has established guidelines that promote the safety and efficacy of natural compounds, which may enhance consumer confidence in polyphenol products. This regulatory support is likely to encourage manufacturers to innovate and incorporate polyphenols into their offerings. As a result, the polyphenol market could experience substantial growth, with an estimated increase in product launches featuring polyphenols by 15% annually. This favorable regulatory environment is expected to bolster the market, as companies align their products with consumer preferences for natural and health-promoting ingredients.

Consumer Preference for Organic Products

The shift towards organic products in Europe is significantly impacting the polyphenol market. Consumers are increasingly seeking organic food and beverages that are perceived as healthier and more environmentally friendly. Polyphenols, often found in organic fruits, vegetables, and beverages, are gaining attention for their potential health benefits. Market data indicates that the organic food market is expected to grow by 9% annually, driven by consumer demand for clean-label products. This trend is likely to encourage manufacturers to source polyphenols from organic sources, thereby expanding the range of organic polyphenol products available in the market. As a result, the polyphenol market may experience growth as consumers prioritize organic options in their purchasing decisions.

Rising Popularity of Functional Beverages

The trend towards functional beverages in Europe is significantly influencing the polyphenol market. Consumers are increasingly opting for drinks that offer health benefits beyond basic nutrition, such as enhanced cognitive function and improved gut health. Polyphenol-rich beverages, including teas, juices, and health drinks, are becoming popular choices among health-conscious consumers. Market analysis indicates that the functional beverage segment is expected to grow by 10% annually, driven by the demand for products that contain beneficial compounds like polyphenols. This rising popularity is likely to create new opportunities for manufacturers to develop innovative beverages that cater to the evolving preferences of consumers, thereby expanding the polyphenol market.

Increased Investment in Research and Development

Investment in research and development (R&D) within the polyphenol market is on the rise in Europe. Companies are focusing on exploring the health benefits of various polyphenols and their applications in food, beverages, and nutraceuticals. This increased R&D activity is expected to lead to the discovery of new polyphenol sources and innovative extraction methods, enhancing product offerings. Recent reports suggest that R&D spending in the food and beverage sector is projected to increase by 12% over the next few years, indicating a strong commitment to innovation. As a result, the polyphenol market may witness a surge in new products that leverage the latest scientific findings, catering to the growing consumer demand for health-oriented solutions.