Germany : Strong Demand and Innovation Drive Growth

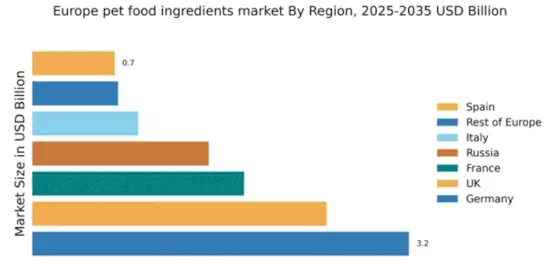

Germany holds a dominant market share of 3.2% in the European pet food-ingredients sector, valued at approximately €1.5 billion. Key growth drivers include a rising pet ownership rate, increasing consumer awareness of pet nutrition, and a shift towards premium and organic ingredients. Regulatory policies favoring animal welfare and food safety standards further enhance market stability. The country boasts advanced infrastructure and a robust supply chain, facilitating efficient distribution and production processes.

UK : Health-Conscious Consumers Shape Trends

The UK pet food-ingredients market accounts for 2.5% of the European share, valued at around €1.2 billion. Growth is fueled by a surge in health-conscious pet owners seeking natural and organic products. Demand for specialized diets, including grain-free and hypoallergenic options, is on the rise. Government initiatives promoting pet welfare and food safety regulations support market growth. The UK has a well-established logistics network, enhancing product availability across regions.

France : Culinary Influence on Pet Nutrition

France represents 1.8% of the European market, with a value of approximately €850 million. The growth is driven by a unique culinary culture that influences pet food formulations, emphasizing high-quality and gourmet ingredients. Trends show increasing demand for locally sourced and organic products. Regulatory frameworks ensure strict compliance with food safety standards. The market is characterized by a mix of traditional and innovative players, fostering a competitive environment.

Russia : Expanding Pet Ownership Trends

Russia's pet food-ingredients market holds a 1.5% share, valued at about €700 million. The growth is propelled by rising pet ownership and a growing middle class seeking premium products. Demand for diverse ingredient options is increasing, alongside a shift towards healthier formulations. Government policies are gradually improving food safety regulations. Key cities like Moscow and St. Petersburg are central to market activities, with a mix of local and international brands competing.

Italy : Growing Demand for Quality Ingredients

Italy's market share stands at 0.9%, valued at approximately €400 million. The growth is driven by changing consumer attitudes towards pet nutrition, with a preference for high-quality and natural ingredients. Demand for functional pet foods is increasing, supported by government initiatives promoting animal health. The competitive landscape includes both local artisans and major international players, particularly in regions like Lombardy and Lazio, where pet ownership is high.

Spain : Focus on Natural Ingredients Rising

Spain accounts for 0.7% of the European market, valued at around €350 million. The market is experiencing growth due to a rising trend towards natural and organic pet food ingredients. Increased awareness of pet health and nutrition is driving demand for premium products. Regulatory frameworks are evolving to enhance food safety standards. Key markets include Madrid and Barcelona, where both local and international brands are vying for consumer attention.

Rest of Europe : Diverse Preferences Across Regions

The Rest of Europe holds a market share of 0.73%, valued at approximately €300 million. This sub-region showcases a fragmented market with diverse consumer preferences and varying regulatory environments. Growth is driven by localized trends, including a focus on sustainability and natural ingredients. The competitive landscape features a mix of small local producers and larger international brands. Countries like Belgium and the Netherlands are notable for their innovative approaches to pet nutrition.