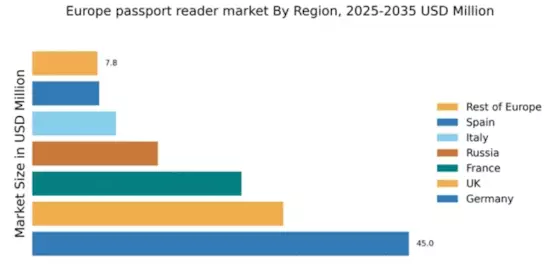

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding 45.0% market share in the European passport reader market, valued at approximately €200 million. Key growth drivers include stringent security regulations and increasing demand for biometric solutions in airports and border control. The German government has initiated several programs to enhance border security, which has spurred infrastructure investments in technology. Additionally, the rise in international travel post-pandemic has further fueled consumption patterns for advanced passport readers.

UK : Innovative Solutions for Security Needs

The UK accounts for 30.0% of the European passport reader market, reflecting a value of around €135 million. Growth is driven by the UK's focus on enhancing border security and the adoption of advanced biometric systems. The UK government has implemented policies to streamline immigration processes, which has increased demand for efficient passport reading technologies. The ongoing development of smart airports and digital border control systems further supports this trend.

France : Government Initiatives Boost Adoption

France holds a 25.0% share of the European passport reader market, valued at approximately €112 million. The growth is propelled by government initiatives aimed at modernizing border control and enhancing security measures. The French government has invested in upgrading airport infrastructure, which has led to increased demand for advanced passport readers. Additionally, the rise in international travel has created a favorable consumption pattern for biometric solutions.

Russia : Growing Demand Amid Regulatory Changes

Russia represents 15.0% of the European passport reader market, valued at about €67 million. The market is driven by increasing government focus on national security and the implementation of new regulations for border control. Recent investments in technology infrastructure have led to a rise in demand for passport readers, particularly in major cities like Moscow and St. Petersburg. The competitive landscape includes both local and international players, enhancing market dynamics.

Italy : Focus on Security and Efficiency

Italy captures 10.0% of the European passport reader market, valued at approximately €45 million. The growth is fueled by the Italian government's efforts to enhance border security and streamline immigration processes. Key cities such as Rome and Milan are pivotal markets, with increasing investments in airport technology. The competitive landscape features major players like Datalogic, which has a strong presence in the region, driving innovation and efficiency in passport reading solutions.

Spain : Investment in Security Infrastructure

Spain holds an 8.0% share of the European passport reader market, valued at around €36 million. The market is driven by the Spanish government's commitment to improving border security and the adoption of biometric technologies. Key cities like Madrid and Barcelona are central to this growth, with ongoing investments in airport infrastructure. The competitive landscape includes both local and international firms, fostering a dynamic business environment for passport readers.

Rest of Europe : Varied Demand Across Regions

The Rest of Europe accounts for 7.78% of the passport reader market, valued at approximately €35 million. This sub-region showcases diverse demand driven by varying regulatory environments and security needs. Countries like Belgium and the Netherlands are key markets, with increasing investments in biometric solutions. The competitive landscape is characterized by a mix of local and international players, creating opportunities for innovation and growth in passport reading technologies.