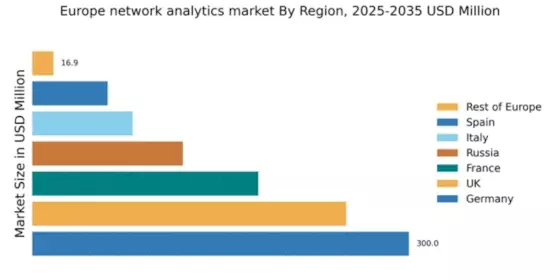

Germany : Strong Growth and Innovation Landscape

Germany holds a dominant position in the European network analytics market, accounting for 300.0 million, representing a significant market share. Key growth drivers include robust industrial automation, increasing cybersecurity concerns, and a strong push towards digital transformation. Government initiatives, such as the Digital Strategy 2025, aim to enhance infrastructure and promote innovation, fostering a conducive environment for network analytics adoption. The demand for real-time data analytics is surging, particularly in sectors like manufacturing and finance, where operational efficiency is paramount.

UK : Strong Demand Across Sectors

The UK network analytics market is valued at 250.0 million, driven by increasing investments in IT infrastructure and cloud services. The demand for analytics solutions is particularly strong in finance, healthcare, and telecommunications, where data-driven decision-making is critical. Regulatory frameworks, such as GDPR, are shaping data management practices, while government initiatives support innovation in technology. The market is characterized by a competitive landscape with significant players like Micro Focus and Cisco Systems leading the charge.

France : Focus on Innovation and Compliance

France's network analytics market is valued at 180.0 million, with growth fueled by the rise of smart cities and IoT applications. The French government promotes digital innovation through initiatives like the National Digital Strategy, which encourages investment in technology. Demand is particularly strong in urban areas like Paris and Lyon, where infrastructure development is accelerating. The competitive landscape features major players such as IBM and Juniper Networks, who are adapting to local market needs and regulatory requirements.

Russia : Focus on Security and Compliance

Russia's network analytics market is valued at 120.0 million, driven by increasing cybersecurity threats and the need for compliance with local regulations. The government has implemented policies to enhance digital security, which is propelling demand for analytics solutions. Key cities like Moscow and St. Petersburg are central to market growth, with a focus on sectors such as telecommunications and finance. The competitive landscape includes both local and international players, with a strong emphasis on security solutions.

Italy : Focus on Digital Transformation

Italy's network analytics market is valued at 80.0 million, with growth driven by the need for digital transformation across various sectors. The Italian government supports initiatives aimed at enhancing digital infrastructure, particularly in manufacturing and retail. Demand is rising in cities like Milan and Rome, where businesses are increasingly adopting analytics solutions to improve operational efficiency. The competitive landscape features key players like Cisco and SolarWinds, who are tailoring their offerings to meet local market demands.

Spain : Investment in Infrastructure and Innovation

Spain's network analytics market is valued at 60.0 million, with growth driven by investments in digital infrastructure and smart city initiatives. The Spanish government is actively promoting technology adoption through various programs, enhancing the business environment for analytics solutions. Key markets include Barcelona and Madrid, where demand for real-time analytics is growing in sectors like tourism and finance. The competitive landscape includes major players such as Netskope and Arista Networks, who are adapting to local needs.

Rest of Europe : Emerging Opportunities Across Regions

The Rest of Europe network analytics market is valued at 16.88 million, characterized by diverse growth opportunities across various countries. Demand is influenced by local regulations and the varying pace of digital transformation. Countries like Belgium and the Netherlands are seeing increased investments in IT infrastructure, while government initiatives support innovation. The competitive landscape is fragmented, with both local and international players vying for market share, focusing on sector-specific applications.