Focus on Operational Efficiency

The pursuit of operational efficiency remains a paramount driver in the manufacturing analytics market in Europe. Companies are increasingly recognizing that optimizing production processes can lead to substantial cost savings and improved profitability. By utilizing analytics, manufacturers can identify bottlenecks, reduce waste, and streamline operations. Reports indicate that organizations implementing analytics solutions can achieve efficiency improvements of up to 25%. This focus on operational excellence is compelling manufacturers to invest in analytics technologies, thereby fostering growth in the market. As competition intensifies, the need for continuous improvement in operational performance is likely to drive further adoption of analytics solutions.

Adoption of Advanced Technologies

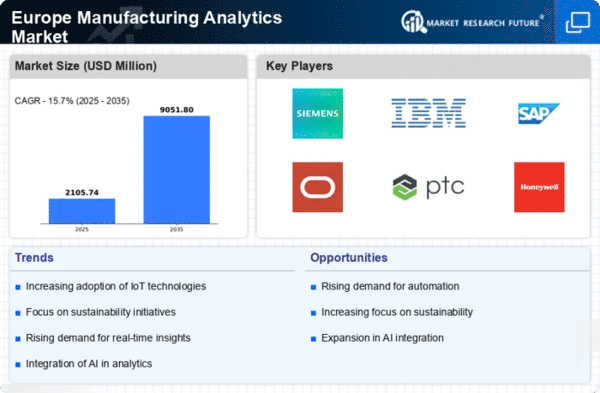

The manufacturing analytics market in Europe is experiencing a notable shift towards the adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enable manufacturers to analyze vast amounts of data, leading to improved operational efficiency and reduced costs. In 2025, it is estimated that the integration of AI in manufacturing processes could enhance productivity by up to 30%. This trend is driven by the need for manufacturers to remain competitive in a rapidly evolving market. As companies increasingly recognize the value of data-driven decision-making, the demand for sophisticated analytics solutions is likely to grow, thereby propelling the manufacturing analytics market forward.

Shift Towards Data-Driven Culture

The shift towards a data-driven culture within manufacturing organizations is significantly impacting the analytics market in Europe. Companies are increasingly prioritizing data literacy and analytics capabilities among their workforce. This cultural transformation encourages employees to leverage data in their decision-making processes, fostering innovation and agility. As organizations invest in training and development, the demand for user-friendly analytics tools is expected to rise. It is estimated that by 2027, the market for analytics training programs could exceed €1 billion, reflecting the growing importance of data-driven strategies in enhancing competitiveness. This cultural shift is likely to sustain the momentum of the manufacturing analytics market.

Demand for Real-Time Data Insights

The increasing demand for real-time data insights is a critical driver of the manufacturing analytics market in Europe. Manufacturers are seeking to leverage analytics to gain immediate visibility into their operations, enabling them to make informed decisions swiftly. This trend is particularly evident in sectors such as automotive and aerospace, where timely data can significantly impact production schedules and supply chain management. It is projected that by 2026, the market for real-time analytics solutions could reach €5 billion, reflecting a compound annual growth rate (CAGR) of 15%. This growing emphasis on real-time insights is likely to enhance the adoption of analytics tools across various manufacturing sectors.

Regulatory Compliance and Standards

In Europe, stringent regulatory frameworks and compliance standards are significantly influencing the manufacturing analytics market. Manufacturers are required to adhere to various regulations concerning quality, safety, and environmental impact. The implementation of analytics solutions aids in monitoring compliance and ensuring that production processes meet these standards. For instance, the European Union's regulations on emissions and waste management necessitate the use of analytics to track and report data accurately. This compliance-driven approach is expected to drive market growth, as companies invest in analytics tools to avoid penalties and enhance their operational transparency.