Regulatory Pressures

The malware protection market in Europe is significantly influenced by regulatory pressures aimed at enhancing data protection and privacy. The implementation of regulations such as the General Data Protection Regulation (GDPR) mandates that organizations adopt stringent measures to protect personal data. Non-compliance can result in hefty fines, which can reach up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory landscape compels businesses to invest in effective malware protection solutions to ensure compliance and avoid penalties. The malware protection market is thus experiencing a surge in demand as organizations strive to meet regulatory requirements while safeguarding their data assets.

Rising Cyber Threats

The malware protection market in Europe is experiencing growth due to the increasing frequency and sophistication of cyber threats. Reports indicate that cybercrime costs European businesses approximately €140 billion annually, highlighting the urgent need for robust malware protection solutions. As organizations face advanced persistent threats and ransomware attacks, the demand for effective malware protection solutions intensifies. This trend is further fueled by the growing reliance on digital infrastructure, which exposes vulnerabilities that cybercriminals exploit. Consequently, businesses are compelled to invest in comprehensive malware protection strategies to safeguard their assets and maintain operational continuity. The malware protection market is thus positioned for significant expansion as organizations prioritize cybersecurity measures to mitigate risks associated with evolving cyber threats.

Increased Remote Work

The shift towards remote work in Europe has created new challenges for cybersecurity, thereby impacting the malware protection market. As employees access corporate networks from various locations, the risk of malware attacks increases. This trend has prompted organizations to enhance their cybersecurity measures, including the implementation of advanced malware protection solutions. According to recent studies, 70% of businesses report an increase in cyber threats since adopting remote work policies. Consequently, the malware protection market is witnessing a surge in demand for solutions that can effectively secure remote access and protect against potential vulnerabilities associated with remote work environments.

Technological Advancements

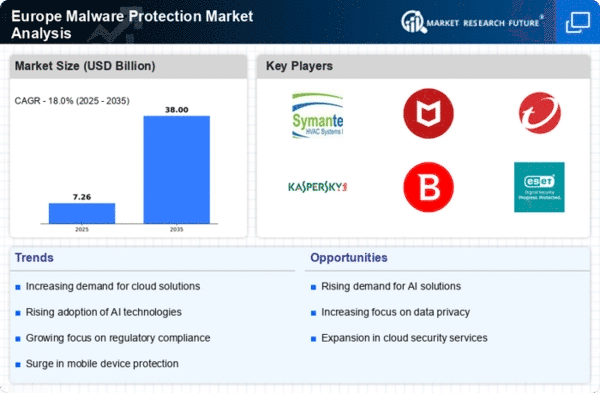

Technological advancements are playing a crucial role in shaping the malware protection market in Europe. Innovations in artificial intelligence and machine learning are enabling the development of more sophisticated malware detection and prevention solutions. These technologies allow for real-time threat analysis and response, significantly enhancing the effectiveness of malware protection strategies. As organizations seek to stay ahead of evolving cyber threats, the demand for advanced malware protection solutions is likely to increase. The malware protection market is thus positioned for growth as businesses invest in cutting-edge technologies to bolster their cybersecurity defenses.

Growing Awareness of Cybersecurity

In Europe, there is a notable increase in awareness regarding the importance of cybersecurity, which is driving the malware protection market. Educational initiatives and high-profile data breaches have heightened public consciousness about the risks associated with inadequate cybersecurity measures. As a result, organizations are more inclined to adopt malware protection solutions to safeguard sensitive information and maintain customer trust. The malware protection market is witnessing a shift in consumer behavior, with businesses actively seeking solutions that offer comprehensive protection against malware and other cyber threats. This growing awareness is likely to lead to increased investments in cybersecurity technologies, further propelling the growth of the malware protection market in Europe.