Integration of Smart Features

The integration of smart features into laser projectors is becoming a pivotal driver in the European market. Consumers increasingly favor projectors equipped with Wi-Fi connectivity, built-in streaming capabilities, and compatibility with smart devices. This trend aligns with the growing demand for multifunctional devices that enhance user experience. The laser projector market is adapting to these preferences, with an estimated 40% of new models expected to incorporate smart technology by 2027. Such features not only simplify the setup process but also expand the range of applications for laser projectors, from home entertainment to business presentations. As consumers seek seamless integration with their digital ecosystems, the incorporation of smart features is likely to play a crucial role in shaping the future of the laser projector market in Europe.

Growing Demand for High-Quality Visuals

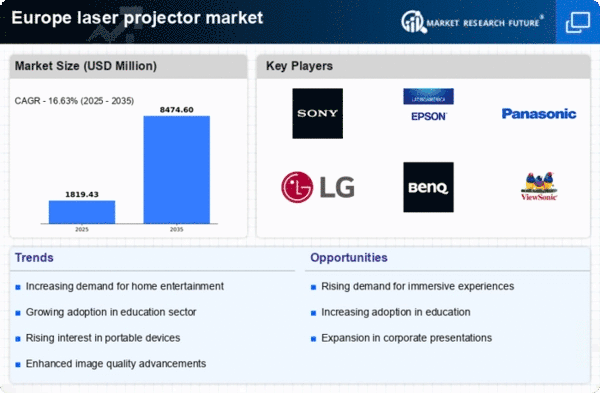

The laser projector market in Europe experiences a notable surge in demand for high-quality visuals across various sectors. Industries such as entertainment, corporate, and education increasingly prioritize superior image clarity and color accuracy. This trend is evidenced by a projected growth rate of approximately 15% annually in the adoption of laser projectors, driven by their ability to deliver vibrant and sharp images. As businesses and educational institutions seek to enhance presentations and learning experiences, the laser projector market is poised to benefit significantly. Furthermore, advancements in laser technology contribute to improved performance, making these projectors more appealing to consumers. The increasing reliance on visual communication in marketing and training further propels this demand, indicating a robust future for the laser projector market in Europe.

Shift Towards Compact and Portable Solutions

The laser projector market in Europe is witnessing a shift towards compact and portable solutions, catering to the evolving needs of consumers. As remote work and mobile presentations become more prevalent, the demand for lightweight and easily transportable projectors is on the rise. This trend is reflected in the market, where portable laser projectors are expected to account for over 30% of total sales by 2026. The convenience of these devices allows users to set up presentations in various locations without compromising on quality. Additionally, advancements in battery technology and wireless connectivity enhance the usability of portable projectors, making them increasingly attractive to professionals and educators alike. This shift towards compact solutions is likely to reshape the landscape of the laser projector market in Europe, driving innovation and competition among manufacturers.

Focus on Energy Efficiency and Cost Reduction

The laser projector market in Europe is experiencing a heightened focus on energy efficiency and cost reduction. As environmental concerns gain prominence, consumers and businesses alike are seeking solutions that minimize energy consumption while maintaining performance. Laser projectors are known for their longevity and lower energy usage compared to traditional projectors, making them an attractive option. The market is witnessing a shift, with an estimated 25% of consumers prioritizing energy-efficient models in their purchasing decisions. This trend not only aligns with sustainability goals but also offers potential cost savings in the long run. Manufacturers are responding by developing more energy-efficient models, which could further enhance the appeal of laser projectors in the European market.

Rising Investment in Event and Entertainment Sectors

The laser projector market in Europe is significantly influenced by rising investments in the event and entertainment sectors. As live events, concerts, and exhibitions become more elaborate, the demand for high-quality projection solutions escalates. The market is projected to grow by approximately 20% over the next five years, driven by the need for immersive visual experiences. Event organizers increasingly recognize the value of laser projectors in creating stunning visuals that captivate audiences. This trend is further supported by advancements in projection technology, which allow for larger and more dynamic displays. Consequently, the laser projector market is likely to see increased collaboration with event planners and production companies, fostering innovation and expanding market reach.