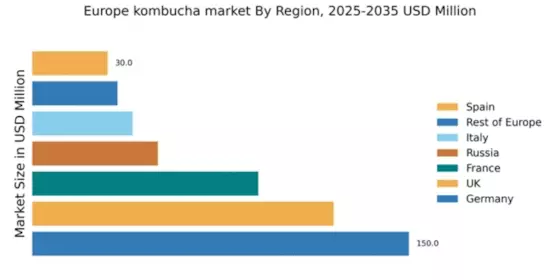

Germany : Strong Demand and Growth Drivers

Germany holds a commanding market share of 150.0 million, representing a significant portion of the European kombucha market. Key growth drivers include a rising health consciousness among consumers, increased availability of products in retail outlets, and favorable regulatory policies promoting organic beverages. The government has initiated programs to support local producers, enhancing infrastructure for beverage manufacturing and distribution, which further fuels market growth.

UK : Health Trends Drive Consumption

The UK kombucha market is valued at 120.0 million, showcasing robust growth driven by health trends and a shift towards natural beverages. Consumers are increasingly seeking alternatives to sugary drinks, leading to a surge in demand for kombucha. Regulatory support for health-focused products and initiatives promoting sustainable practices are also contributing to market expansion. The UK’s well-developed retail infrastructure facilitates easy access to kombucha products.

France : Cultural Shift Towards Wellness

France's kombucha market is valued at 90.0 million, reflecting a growing interest in wellness beverages. The rise in health awareness and the popularity of organic products are key growth drivers. French consumers are increasingly opting for low-sugar, probiotic-rich drinks, aligning with global health trends. Government initiatives supporting organic farming and beverage innovation are enhancing market conditions for kombucha producers.

Russia : Cultural Acceptance of Fermented Drinks

Russia's kombucha market, valued at 50.0 million, is characterized by a cultural acceptance of fermented beverages. The growth is driven by increasing health awareness and a shift towards natural products. Local regulations are becoming more favorable for beverage production, encouraging new entrants. The market is still developing, with potential for significant growth as consumer preferences evolve towards healthier options.

Italy : Health-Conscious Consumers on the Rise

Italy's kombucha market is valued at 40.0 million, with a notable increase in consumer interest in health-oriented beverages. The growth is fueled by a cultural shift towards wellness and organic products. Regulatory frameworks are becoming more supportive of health-focused beverages, and local producers are innovating to meet consumer demands. The market is still in its infancy, with opportunities for expansion in urban areas.

Spain : Growing Demand for Healthy Beverages

Spain's kombucha market, valued at 30.0 million, is witnessing a gradual increase in demand driven by health trends. Consumers are becoming more health-conscious, leading to a preference for low-sugar, probiotic drinks. Regulatory support for organic products is enhancing market conditions. Major cities like Madrid and Barcelona are key markets, with local producers emerging to cater to the growing consumer base.

Rest of Europe : Varied Market Dynamics Across Regions

The Rest of Europe kombucha market, valued at 34.0 million, showcases diverse market dynamics influenced by local consumer preferences. Growth drivers include increasing health awareness and the popularity of organic beverages. Regulatory environments vary, with some countries offering strong support for health-focused products. The competitive landscape includes both local and international players, with opportunities for growth in niche markets.