Expansion of 5G Networks

The rollout of 5G networks across Europe is a significant catalyst for the IoT operating-systems market. With 5G technology offering enhanced speed, lower latency, and greater connectivity, the potential for IoT applications expands dramatically. By 2025, it is anticipated that 5G will cover over 50% of the European population, facilitating the deployment of advanced IoT solutions in sectors such as healthcare, transportation, and smart cities. This increased connectivity demands operating systems that can efficiently manage high volumes of data and support real-time communication. Thus, the IoT operating-systems market is likely to benefit from the 5G expansion, as it enables more sophisticated and responsive IoT applications.

Rising Demand for Smart Devices

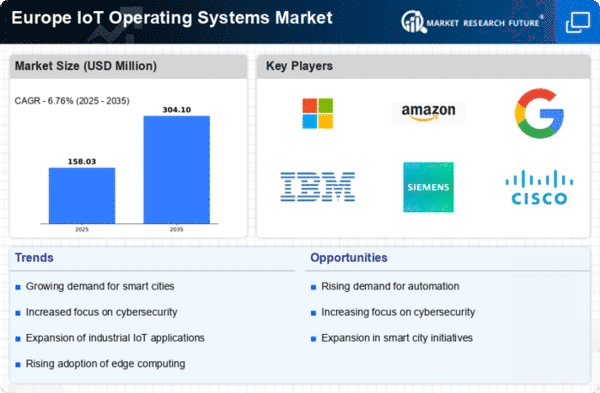

The increasing proliferation of smart devices across various sectors in Europe is a primary driver for the IoT operating-systems market. As consumers and businesses alike adopt smart technologies, the need for robust operating systems that can efficiently manage these devices becomes paramount. In 2025, it is estimated that the number of connected devices in Europe will surpass 1 billion, leading to a projected market growth of approximately 15% annually. This surge in demand necessitates advanced operating systems capable of handling diverse applications, ensuring seamless connectivity, and providing real-time data processing. Consequently, the IoT operating-systems market is poised to expand significantly, driven by the need for enhanced functionality and user experience in smart devices.

Growing Emphasis on Sustainability

The growing emphasis on sustainability and environmental responsibility is influencing the IoT operating-systems market. European governments and organizations are increasingly prioritizing green technologies and energy-efficient solutions. This trend is reflected in the European Green Deal, which aims to make Europe climate-neutral by 2050. As a result, there is a rising demand for IoT systems that can monitor and optimize energy consumption, reduce waste, and enhance resource management. The IoT operating-systems market must adapt to these sustainability goals by developing systems that support eco-friendly applications and facilitate compliance with environmental regulations. This shift towards sustainability is expected to drive innovation and growth within the market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into IoT systems is transforming the landscape of the IoT operating-systems market. AI enhances the capabilities of IoT devices, enabling them to learn from data and make autonomous decisions. In Europe, the AI market is expected to grow at a CAGR of 20% from 2025 to 2030, which will likely influence the development of IoT operating systems. These systems must evolve to support AI functionalities, such as machine learning algorithms and predictive analytics. As a result, the IoT operating-systems market is experiencing a shift towards more intelligent and adaptive systems, which can optimize performance and improve user engagement.

Increased Investment in Smart Infrastructure

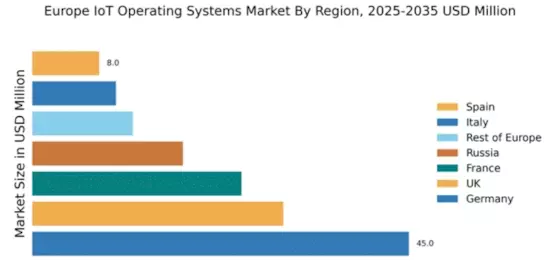

The surge in investment in smart infrastructure projects across Europe is a key driver for the IoT operating-systems market. Governments and private sectors are allocating substantial funds to develop smart cities, transportation systems, and energy grids. In 2025, it is projected that investments in smart infrastructure will reach €200 billion, creating a robust demand for IoT solutions. These projects require sophisticated operating systems capable of integrating various technologies and managing complex data flows. Consequently, the IoT operating-systems market is likely to experience significant growth as it supports the development of interconnected systems that enhance urban living and operational efficiency.