Increasing Health Consciousness

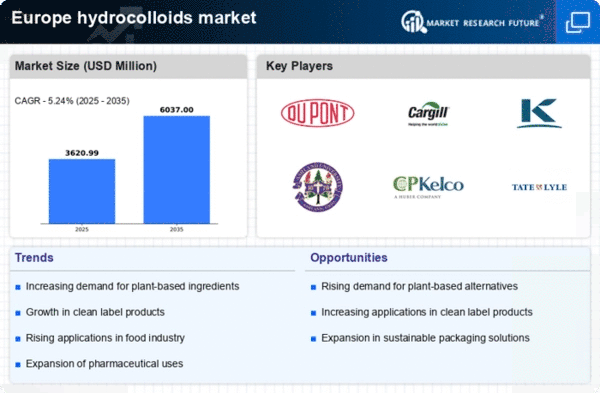

The growing awareness of health and wellness among consumers in Europe is driving the hydrocolloids market. As individuals become more health-conscious, there is a notable shift towards natural and functional food ingredients. Hydrocolloids, known for their thickening, gelling, and stabilizing properties, are increasingly utilized in food products that cater to health trends. For instance, the demand for low-calorie and gluten-free products has surged, leading to a projected growth rate of approximately 6% in the hydrocolloids market by 2027. This trend indicates a significant opportunity for manufacturers to innovate and develop products that align with consumer preferences for healthier options.

Rising Demand for Clean Label Products

The trend towards clean label products is significantly influencing the hydrocolloids market in Europe. Consumers are increasingly seeking transparency in food ingredients, preferring products that are free from artificial additives and preservatives. Hydrocolloids, often derived from natural sources, align well with this demand. As a result, manufacturers are reformulating their products to include hydrocolloids that meet clean label standards. This shift is expected to drive the hydrocolloids market, with a projected increase of 5% in clean label product offerings by 2026. The emphasis on clean labels not only enhances consumer trust but also encourages innovation in product development.

Expansion of the Food and Beverage Sector

The food and beverage sector in Europe is experiencing robust growth, which is positively impacting the hydrocolloids market. With the increasing consumption of processed and convenience foods, the demand for hydrocolloids as stabilizers and emulsifiers is on the rise. In 2025, the food and beverage industry is expected to account for over 70% of the total hydrocolloids market share. This expansion is driven by changing lifestyles and the need for quick meal solutions, prompting manufacturers to incorporate hydrocolloids to enhance texture and shelf life. Consequently, this sector's growth presents a lucrative opportunity for hydrocolloid suppliers.

Regulatory Support for Natural Ingredients

Regulatory frameworks in Europe are increasingly favoring the use of natural ingredients in food products, which is beneficial for the hydrocolloids market. Policies promoting the reduction of synthetic additives and encouraging the use of natural alternatives are creating a favorable environment for hydrocolloid applications. This regulatory support is likely to enhance the market potential for hydrocolloids, as manufacturers seek compliant solutions that meet consumer demands for natural products. The anticipated growth in the hydrocolloids market could reach 7% by 2027, driven by this supportive regulatory landscape that encourages innovation and the adoption of natural hydrocolloids.

Technological Innovations in Food Processing

Technological advancements in food processing techniques are playing a crucial role in shaping the hydrocolloids market. Innovations such as high-pressure processing and advanced emulsification methods are enabling the effective use of hydrocolloids in various applications. These technologies enhance the functional properties of hydrocolloids, allowing for improved texture and stability in food products. As food manufacturers adopt these technologies, the demand for hydrocolloids is likely to increase, with an estimated growth of 4% in the market by 2026. This trend suggests that ongoing research and development in food processing will continue to drive the hydrocolloids market forward.