E-commerce Growth

The rapid expansion of e-commerce platforms is significantly impacting the herbal tea market in Europe. As consumers increasingly turn to online shopping for convenience, the availability of herbal teas through various digital channels is on the rise. This shift is supported by data indicating that online sales of herbal teas are projected to grow by 15% annually, reflecting changing consumer behaviors. E-commerce allows brands to reach a broader audience and offer a wider range of products, including niche and specialty herbal teas that may not be available in traditional retail outlets. The ease of access to product information and customer reviews further enhances the online shopping experience, making it a preferred choice for many consumers. Consequently, the growth of e-commerce is likely to play a pivotal role in shaping the future of the herbal tea market.

Rising Health Consciousness

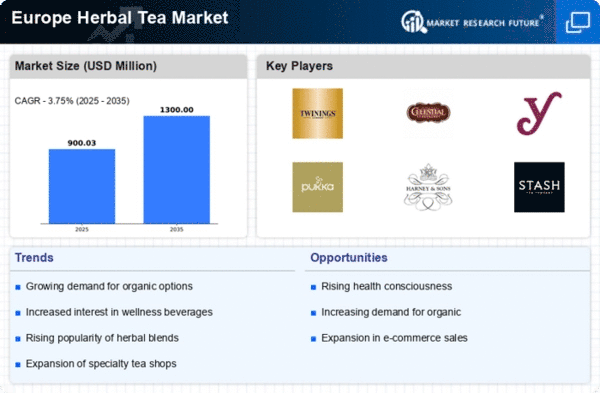

The increasing awareness of health and wellness among consumers in Europe appears to be a primary driver for the herbal tea market. As individuals seek natural alternatives to traditional beverages, herbal teas are gaining traction due to their perceived health benefits. According to recent data, the herbal tea market in Europe is projected to grow at a CAGR of approximately 6.5% from 2025 to 2030. This growth is likely fueled by the demand for products that support immunity, digestion, and relaxation. Consumers are increasingly inclined to choose herbal teas over sugary drinks, which may contribute to a shift in purchasing habits. The emphasis on preventive health measures and the desire for organic and natural ingredients further bolster the appeal of herbal teas, positioning them as a staple in the daily routines of health-conscious individuals.

Innovative Product Development

Innovation within the herbal tea market is driving consumer interest and expanding product offerings. Manufacturers are increasingly experimenting with unique blends, flavors, and functional ingredients to cater to diverse consumer preferences. For instance, the introduction of adaptogenic herbs and superfoods into herbal tea formulations is gaining popularity. This trend is reflected in the market, where innovative products are expected to account for a significant share of sales, potentially reaching €500 million by 2027. The focus on creating premium, artisanal products also resonates with consumers seeking quality over quantity. As brands strive to differentiate themselves, the introduction of limited-edition flavors and seasonal blends may further enhance consumer engagement and loyalty, thereby propelling the growth of the herbal tea market.

Sustainability and Ethical Sourcing

Sustainability has emerged as a crucial factor influencing consumer choices in the herbal tea market. European consumers are increasingly prioritizing products that are ethically sourced and environmentally friendly. This trend is evident in the rising demand for organic herbal teas, which are perceived as healthier and more sustainable options. According to market analysis, the organic segment of the herbal tea market is expected to grow by 8% annually, reflecting a shift towards eco-conscious consumption. Brands that adopt sustainable practices, such as fair trade sourcing and eco-friendly packaging, are likely to attract a loyal customer base. This commitment to sustainability not only enhances brand reputation but also aligns with the values of environmentally aware consumers, thereby driving sales in the herbal tea market.

Cultural Trends and Lifestyle Changes

Cultural shifts and evolving lifestyle choices are influencing the herbal tea market in Europe. As consumers increasingly embrace wellness-oriented lifestyles, herbal teas are becoming integral to daily routines. The trend towards mindfulness and self-care has led to a rise in the consumption of herbal teas as a means of relaxation and stress relief. Market data suggests that herbal tea consumption is expected to increase by 10% over the next five years, driven by the desire for calming and soothing beverages. Additionally, the growing popularity of tea rituals and social tea-drinking experiences may further enhance the appeal of herbal teas. As consumers seek to incorporate wellness practices into their lives, the herbal tea market is likely to benefit from these cultural trends.