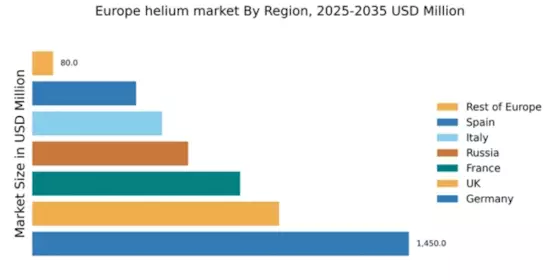

Germany : Strong industrial base drives demand

Germany holds a dominant position in the European helium market, accounting for approximately 36.3% of the total market share with a value of $1450.0 million. Key growth drivers include the booming automotive and aerospace sectors, which are increasingly utilizing helium for various applications. Regulatory policies promoting clean energy and technological advancements in helium extraction are also contributing to market expansion. The country’s robust infrastructure supports efficient distribution and consumption patterns, enhancing overall market dynamics.

UK : Innovation fuels helium consumption

The UK helium market is valued at $950.0 million, representing about 24.5% of the European market. Growth is driven by sectors such as healthcare, electronics, and entertainment, where helium is essential for MRI machines and high-tech applications. Government initiatives aimed at reducing carbon emissions are also fostering demand for helium in renewable energy technologies. The market is characterized by a shift towards sustainable practices, influencing consumption trends.

France : Diverse applications drive growth

France's helium market is valued at $800.0 million, capturing 20.4% of the European market. The growth is propelled by the aerospace and medical sectors, where helium is crucial for various applications. Regulatory frameworks supporting environmental sustainability and innovation are enhancing market conditions. The country’s strategic location and advanced logistics infrastructure facilitate efficient helium distribution across Europe, further boosting demand.

Russia : Resource-rich landscape supports growth

Russia's helium market, valued at $600.0 million, accounts for 15.3% of the European market. The country benefits from vast natural gas reserves, which are a significant source of helium. Government initiatives aimed at developing the gas extraction industry are driving market growth. Demand is increasing in sectors like energy and technology, where helium is used for cooling and other applications, reflecting a positive consumption trend.

Italy : Key player in European market

Italy's helium market is valued at $500.0 million, representing 12.7% of the European market. The growth is primarily driven by the manufacturing and healthcare sectors, where helium is used in various applications. Regulatory support for industrial innovation and environmental sustainability is enhancing market conditions. The competitive landscape includes major players like Air Liquide and Messer Group, which have a strong presence in the region.

Spain : Healthcare and technology drive demand

Spain's helium market is valued at $400.0 million, accounting for 10.2% of the European market. The growth is fueled by the healthcare sector, particularly in medical imaging, and the technology sector, where helium is used in semiconductor manufacturing. Government policies promoting technological advancement and healthcare innovation are supporting market expansion. The competitive landscape features both local and international players, enhancing market dynamics.

Rest of Europe : Diverse applications across regions

The Rest of Europe helium market is valued at $80.0 million, representing 2.0% of the total market. This segment includes smaller markets with specific applications in niche industries such as research and development, where helium is essential for various scientific processes. Regulatory frameworks vary by country, influencing market dynamics. The competitive landscape is characterized by local suppliers and smaller players, catering to unique regional demands.