Rising Consumer Expectations

Consumer expectations in the Europe Generative Ai In Fintech Market are evolving rapidly, driven by the demand for personalized and seamless financial experiences. As consumers become more accustomed to AI-driven services in other sectors, they expect similar levels of personalization and efficiency from financial institutions. This shift is prompting fintech companies to invest in generative AI technologies that can analyze customer data and deliver tailored solutions. Market Research Future indicates that 70 percent of consumers are more likely to engage with a financial service that offers personalized recommendations. Consequently, the pressure to meet these rising expectations is likely to propel further advancements in generative AI applications within the European fintech landscape.

Collaboration and Partnerships

Collaboration between fintech startups and traditional financial institutions is a driving force in the Europe Generative Ai In Fintech Market. As established banks seek to innovate and remain competitive, they are increasingly partnering with agile fintech companies that specialize in generative AI technologies. These collaborations enable traditional banks to leverage cutting-edge solutions while fintech startups gain access to established customer bases and regulatory expertise. Recent data suggests that partnerships in the fintech sector have increased by 40 percent over the past year, highlighting a trend towards cooperative innovation. This synergy is likely to enhance the development and deployment of generative AI solutions across Europe, fostering a more dynamic financial ecosystem.

Growing Focus on Data Security

Data security remains a paramount concern within the Europe Generative Ai In Fintech Market. With the increasing reliance on AI-driven solutions, financial institutions are prioritizing the protection of sensitive customer information. The European Union's General Data Protection Regulation (GDPR) has set stringent guidelines for data handling, compelling fintech companies to adopt robust security measures. As a result, investments in generative AI technologies that enhance data security protocols are on the rise. It is estimated that the market for AI-driven cybersecurity solutions in Europe could reach 20 billion euros by 2027, indicating a strong alignment between generative AI advancements and the need for enhanced data protection.

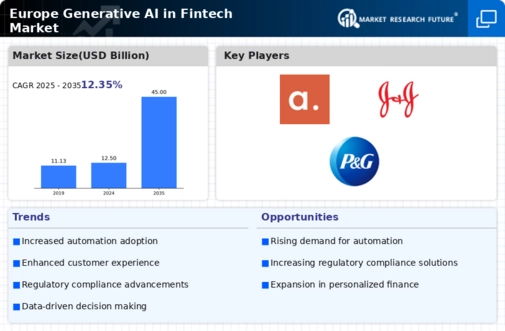

Increased Demand for Automation

The Europe Generative Ai In Fintech Market is experiencing a notable surge in demand for automation solutions. Financial institutions are increasingly adopting generative AI technologies to streamline operations, reduce costs, and enhance efficiency. According to recent data, automation in financial services can lead to a reduction in operational costs by up to 30 percent. This trend is particularly evident in areas such as customer service, where AI-driven chatbots and virtual assistants are deployed to handle inquiries, thereby freeing human resources for more complex tasks. As the competitive landscape intensifies, the need for automation is likely to drive further investments in generative AI technologies across Europe.

Regulatory Support for Innovation

The Europe Generative Ai In Fintech Market benefits from a regulatory environment that increasingly supports innovation. European regulators are recognizing the potential of generative AI to transform financial services and are working to create frameworks that encourage its adoption. Initiatives such as the European Commission's Digital Finance Strategy aim to foster innovation while ensuring consumer protection and financial stability. This supportive regulatory landscape is likely to stimulate investment in generative AI technologies, as fintech companies seek to leverage these advancements to develop new products and services. The potential for regulatory sandboxes further enhances this environment, allowing startups to test innovative solutions in a controlled setting.