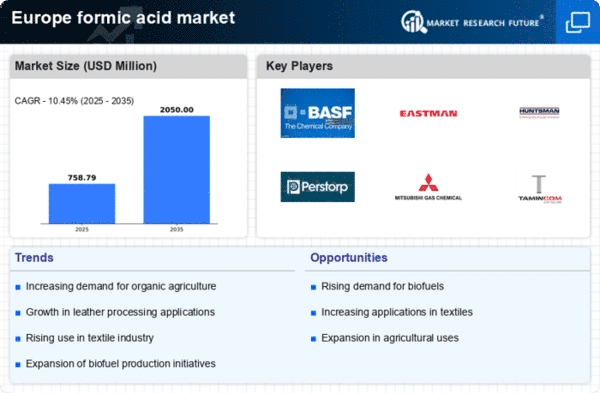

Growth in Textile Industry

The textile industry in Europe significantly influences the formic acid market, as this chemical is utilized in various textile processing applications. Formic acid acts as a dyeing and finishing agent, improving the color fastness and overall quality of fabrics. With the European textile market projected to reach €100 billion by 2026, the demand for formic acid is likely to increase correspondingly. Additionally, the push for sustainable textiles has led to a growing interest in eco-friendly chemicals, positioning formic acid as a viable option. The integration of formic acid in textile production processes not only enhances product quality but also aligns with the industry's shift towards sustainability, thereby driving growth in the formic acid market.

Rising Demand in Animal Feed

The formic acid market in Europe is positively impacted by the rising demand for animal feed additives. Formic acid is recognized for its antimicrobial properties, which help in preserving feed quality and enhancing animal health. The European animal feed market, valued at approximately €30 billion, is increasingly incorporating formic acid to improve feed efficiency and reduce spoilage. As livestock production intensifies to meet the growing demand for meat and dairy products, the utilization of formic acid in feed formulations is expected to expand. This trend not only supports the health of livestock but also contributes to the overall efficiency of the agricultural sector, thereby reinforcing the position of formic acid in the market.

Increasing Use in Leather Tanning

The formic acid market in Europe experiences a notable driver from its increasing application in the leather tanning industry. Formic acid serves as a crucial agent in the tanning process, enhancing the quality and durability of leather products. The European leather industry, valued at approximately €20 billion, relies heavily on effective tanning agents, with formic acid being favored for its efficiency and environmental compatibility. As consumer preferences shift towards high-quality leather goods, the demand for formic acid in this sector is expected to rise. Furthermore, the trend towards sustainable practices in leather production may further bolster the formic acid market, as manufacturers seek eco-friendly alternatives that do not compromise on quality.

Expansion of Renewable Energy Sector

The expansion of the renewable energy sector in Europe serves as a significant driver for the formic acid market. Formic acid is being explored as a potential energy carrier and storage solution, particularly in hydrogen production and fuel cells. With the European Union's commitment to achieving carbon neutrality by 2050, investments in renewable energy technologies are surging. The market for hydrogen, which could utilize formic acid as a storage medium, is projected to grow substantially, potentially reaching €100 billion by 2030. This shift towards renewable energy not only opens new avenues for formic acid applications but also aligns with broader sustainability goals, thereby enhancing its market potential.

Advancements in Chemical Manufacturing

Technological advancements in chemical manufacturing processes are driving the formic acid market in Europe. Innovations in production techniques, such as more efficient catalytic processes, have led to increased yields and reduced production costs. This evolution in manufacturing is crucial, as it allows for the production of high-purity formic acid, which is essential for various applications, including pharmaceuticals and agrochemicals. The European chemical industry, valued at over €500 billion, is continuously seeking ways to enhance efficiency and sustainability. As manufacturers adopt these advanced techniques, the availability of competitively priced formic acid is likely to increase, thereby stimulating demand across multiple sectors and reinforcing the formic acid market.