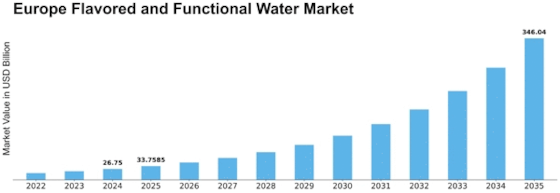

Europe Flavored And Functional Water Size

Europe Flavored and Functional Water Market Growth Projections and Opportunities

The Europe flavored and functional water market is influenced by a variety of factors that collectively shape its growth and dynamics. One of the primary drivers is the increasing awareness of health and wellness among consumers. With a growing emphasis on maintaining a healthy lifestyle, flavored and functional water has gained popularity as a refreshing and low-calorie alternative to sugary beverages. Consumers are seeking hydration options with added benefits, such as vitamins, minerals, antioxidants, and natural flavors, contributing to the rise of the flavored and functional water market in Europe.

Changing consumer preferences and dietary trends also play a crucial role in shaping the market. As consumers become more health-conscious, there is a shift away from traditional carbonated and sugary drinks towards healthier beverage options. Flavored and functional waters, often infused with botanicals, herbs, and natural flavors, align with the demand for beverages that provide both hydration and functional benefits. The versatility of these products, which can cater to various consumer preferences, contributes to their popularity in the European market.

The food and beverage industry's focus on innovation and product diversification further drives the market trends in flavored and functional water. Manufacturers are continually introducing new and unique formulations to meet consumer demands for exciting and novel flavors. Functional ingredients, such as electrolytes, probiotics, and adaptogens, are often incorporated to enhance the health benefits of these beverages. The evolving tastes of consumers and the desire for experiential beverages influence the market's growth, prompting companies to invest in research and development to stay competitive.

Geographical and demographic factors also influence the flavored and functional water market in Europe. Different regions may have varying preferences for specific flavors or ingredients, and understanding these regional nuances is crucial for market participants. Additionally, demographic factors such as age and lifestyle choices impact consumption patterns. The appeal of flavored and functional water to health-conscious millennials and the aging population looking for healthier beverage options contribute to market dynamics.

Environmental considerations are gaining prominence in the flavored and functional water market. With an increasing focus on sustainability, consumers are becoming more mindful of the environmental impact of packaging and production processes. Companies adopting eco-friendly packaging, promoting recycling initiatives, and ensuring transparent sourcing practices may attract environmentally conscious consumers, contributing to market growth and brand loyalty.

Economic conditions and consumer purchasing power contribute to market dynamics. In periods of economic stability, consumers may be more willing to spend on premium and innovative flavored and functional water products. Conversely, during economic downturns, there may be a shift towards more cost-conscious choices. Market participants need to consider these economic dynamics and adjust pricing strategies and product offerings accordingly.

The impact of regulatory standards and labeling requirements is another critical factor in the flavored and functional water market. Stringent regulations govern the labeling of health claims, nutritional content, and ingredient transparency. Compliance with these standards is essential for building consumer trust and ensuring the credibility of health-related claims. Companies that prioritize adherence to regulatory requirements often establish a positive brand image and foster consumer confidence.

Distribution channels and retail partnerships are essential elements in the flavored and functional water market. The accessibility of these beverages through supermarkets, convenience stores, and online platforms impacts consumer reach and market penetration. Collaborations with retailers and effective distribution strategies contribute to the visibility and availability of flavored and functional water, influencing purchasing decisions and brand loyalty.

Leave a Comment