Europe Electric Trucks Size

Market Size Snapshot

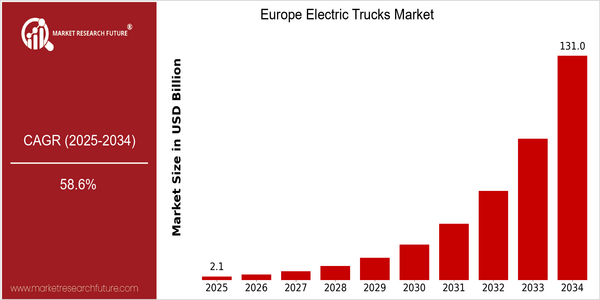

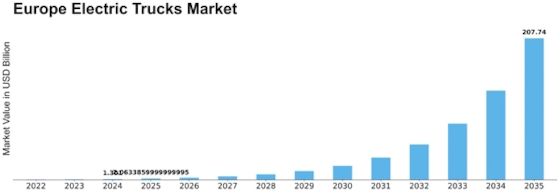

| Year | Value |

|---|---|

| 2025 | USD 2.06 Billion |

| 2034 | USD 130.98 Billion |

| CAGR (2025-2034) | 58.6 % |

Note – Market size depicts the revenue generated over the financial year

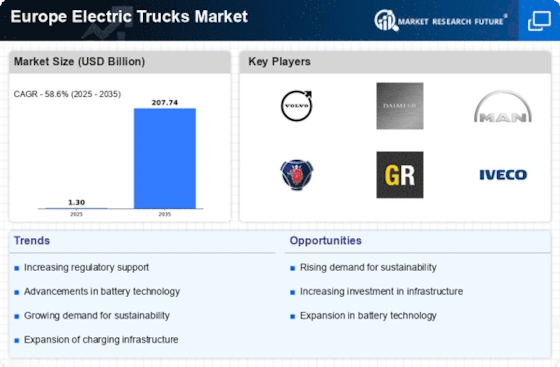

The Electric Trucks Market in Europe is set for a staggering growth, with a market size of $2.06 billion in 2025 expected to surge to $130.98 billion by 2034, at a staggering CAGR of 58.6%. The massive growth is due to a growing shift in the transportation sector towards sustainable and eco-friendly solutions, driven by the increasing demand for efficient logistics solutions, as well as increasing regulatory pressure to reduce carbon emissions. The transition to electric trucks is not a mere trend, but a fundamental shift in the way goods are transported across Europe, in line with the broader trend towards eco-friendly solutions and a consumer preference for greener products. This is a multi-faceted trend, driven by several factors, including advancements in battery technology, which has increased the range and efficiency of electric trucks, making them more viable for commercial use. Government incentives and subsidies are also expected to drive the growth of the market. Several major players in the industry, such as Tesla, Daimler, and Volvo, are investing in the development of electric trucks and entering strategic alliances to enhance their product offerings. These developments are a sign of the innovation and advancements being made in the industry. For example, the launch of the electric truck by Tesla, the Semi, and Daimler’s plans to electrify its entire fleet are notable developments in this regard. These developments are expected to accelerate the growth of the market, and electric trucks are expected to become a staple of the future transportation sector.

Regional Market Size

Regional Deep Dive

The European Electric Trucks Market is growing at a steady pace owing to the growing demand for sustainable transportation solutions and the advancements in the battery technology. In Europe, the governments are keen on reducing the carbon emissions and are therefore setting ambitious goals for the electric vehicles. The presence of the major automobile manufacturers and the well-established charging network are the other factors that are expected to support the market growth.

Europe

- The European Union has implemented the Green Deal, which aims to make Europe the first climate-neutral continent by 2050, significantly influencing the electric truck market through regulatory support and funding.

- Major manufacturers such as Volvo and Daimler are investing heavily in electric truck development, with Volvo launching its electric truck range in several European countries, showcasing a shift towards sustainable logistics.

Asia Pacific

- China is rapidly expanding its electric truck market, supported by government subsidies and a strong push for electric vehicle adoption, making it a global leader in electric truck production.

- Innovations in battery technology from companies like BYD are enhancing the performance and affordability of electric trucks, which is expected to drive market growth in the region.

Latin America

- Brazil is exploring electric truck options as part of its broader strategy to reduce emissions, with local manufacturers beginning to develop electric models.

- Government incentives and partnerships with international companies are emerging to support the transition to electric trucks in the region.

North America

- The U.S. government has introduced various incentives for electric vehicle adoption, including tax credits and grants, which are expected to boost the electric truck market significantly.

- Companies like Tesla and Rivian are leading innovations in electric truck technology, focusing on longer ranges and faster charging capabilities, which are crucial for commercial applications.

Middle East And Africa

- The Middle East is witnessing a gradual shift towards electric trucks, with countries like the UAE investing in sustainable transport initiatives as part of their Vision 2021 strategy.

- Local companies are beginning to explore electric truck options, but the market is still in its infancy due to economic factors and a lack of infrastructure.

Did You Know?

“In 2022, electric trucks accounted for approximately 1% of total truck sales in Europe, but this figure is expected to rise sharply as manufacturers ramp up production and infrastructure improves.” — European Automobile Manufacturers Association (ACEA)

Segmental Market Size

The European electric truck market is growing strongly, driven by a rise in the number of trucks that are subject to stricter regulations, as well as a growing demand for sustainable transport solutions. The escalating cost of fossil fuels also makes it attractive to switch to electric vehicles. Moreover, the latest developments in battery technology are making electric trucks even more efficient, thus enhancing their appeal to transport companies. At the present time, the market is in the early stages of commercialization, with companies such as Volvo and Daimler at the forefront of electric truck production. As for the regions, the Nordic countries and the Netherlands are in the lead, deploying electric trucks for urban logistics and public transport. Typical applications are local deliveries, waste collection and regional transport. Moreover, trends such as the European Green Deal and various local low-emission zones are stimulating the take-up of electric trucks. Vehicle-to-grid and advanced telematics are also contributing to the evolution of the market, by enabling better energy management and improved operational visibility.

Future Outlook

From 2025 to 2034, the European electric trucks market will grow at an annual average rate of 58%. The growth will be driven by the combination of tightening emissions regulations, the development of batteries and the increasing investment in charging points. In 2034, the share of electric trucks in the European commercial vehicle market is expected to reach about 30%, indicating a significant shift towards sustainable mobility solutions. Technological progress, such as the development of batteries with higher energy density and the development of ultra-fast charging systems, will be key to improving the economic feasibility of electric trucks. Government support, such as subsidies and incentives, will also be a key factor in promoting the development of electric trucks. Also, the trend towards integrating automation and the rise of sustainable logistics companies will have a significant impact on the market. As companies continue to recognize the long-term cost benefits and the positive impact of electric trucks on the environment, the market will develop rapidly, and Europe will become a leading country in the transition to electric commercial vehicles.

Leave a Comment