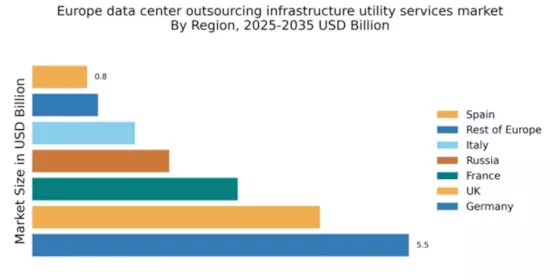

Germany : Strong Infrastructure and Innovation Hub

Germany holds a commanding 5.5% market share in the data center outsourcing infrastructure utility services sector, valued at approximately €5 billion. Key growth drivers include a robust digital economy, increasing demand for cloud services, and favorable regulatory frameworks. The German government has initiated several policies to promote digitalization, enhancing infrastructure development and attracting foreign investments. The country’s commitment to renewable energy also supports sustainable data center operations.

UK : Innovation and Regulatory Support

The UK commands a 4.2% market share, valued at around €4 billion, driven by rapid cloud adoption and a strong fintech sector. Demand for data center services is fueled by increasing data consumption and the need for compliance with stringent data protection regulations like GDPR. The UK government actively supports digital infrastructure development, fostering a conducive environment for tech startups and established players alike.

France : Strategic Location and Growth Potential

France holds a 3.0% market share, valued at approximately €3 billion, with growth driven by its strategic location in Europe and increasing demand for cloud services. The French government has implemented initiatives to enhance digital infrastructure, including investments in fiber optics and renewable energy. The market is characterized by a growing number of data centers in cities like Paris and Lyon, catering to various sectors including finance and e-commerce.

Russia : Government Initiatives and Investment

Russia's market share stands at 2.0%, valued at around €2 billion, with growth driven by government initiatives aimed at enhancing digital infrastructure. The demand for data centers is increasing, particularly in major cities like Moscow and St. Petersburg, as businesses seek to modernize their IT capabilities. Regulatory support for local data storage and cybersecurity is also fostering a more favorable business environment for data center operations.

Italy : Investment in Digital Transformation

Italy has a market share of 1.5%, valued at approximately €1.5 billion, with growth fueled by increasing cloud adoption and digital transformation initiatives. The Italian government is promoting investments in digital infrastructure, particularly in regions like Lombardy and Lazio. The competitive landscape includes major players like IBM and local providers, catering to sectors such as manufacturing and retail, which are increasingly reliant on data-driven solutions.

Spain : Focus on Digitalization and Innovation

Spain's market share is 0.8%, valued at around €800 million, with growth driven by a focus on digitalization and innovation. The Spanish government has launched initiatives to enhance digital infrastructure, particularly in cities like Madrid and Barcelona. The competitive landscape features both international giants and local players, with a growing demand for data center services in sectors like tourism and e-commerce, reflecting changing consumption patterns.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe holds a market share of 0.96%, valued at approximately €960 million, with diverse growth opportunities across various countries. Factors driving growth include increasing digitalization, regulatory support, and investments in infrastructure. Countries like the Netherlands and Belgium are emerging as key players in the data center market, attracting investments from major cloud service providers. The competitive landscape is characterized by a mix of local and international players, catering to various industries.