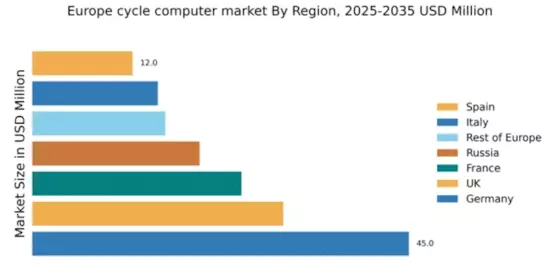

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Hamburg, where cycling is integrated into urban planning. The competitive landscape features strong players such as Sigma Sport and Garmin, which dominate with innovative products. Local dynamics favor high-quality, feature-rich devices, catering to both recreational and professional cyclists. The presence of cycling clubs and events further stimulates market growth, making Germany a hub for cycling technology and innovation.

UK : Increasing Popularity of Cycling Culture

Key markets include London, Manchester, and Bristol, where cycling infrastructure is rapidly developing. The competitive landscape features major players like Garmin and Wahoo Fitness, which offer a range of products tailored to different cycling needs. Local dynamics are influenced by a vibrant cycling community and numerous events, fostering a supportive environment for market growth. The rise of e-bikes also contributes to increased demand for cycle computers.

France : Cycling as a Lifestyle Choice

Key markets include Paris, Lyon, and Marseille, where cycling is increasingly integrated into daily life. The competitive landscape features brands like Cateye and Polar, which cater to various segments of the market. Local dynamics are characterized by a strong cycling culture, with events like the Tour de France boosting interest in cycling technology. The market is also influenced by a growing trend towards eco-friendly transportation solutions.

Russia : Cycling Gains Popularity in Urban Areas

Key markets include Moscow and St. Petersburg, where cycling infrastructure is being developed. The competitive landscape is still evolving, with brands like Bryton and Sigma Sport gaining traction. Local dynamics are influenced by a growing interest in cycling as a recreational activity, supported by community events and cycling clubs. The market is also seeing an influx of international brands, enhancing product availability and variety.

Italy : Diverse Applications and Enthusiastic Riders

Key markets include cities like Milan, Rome, and Florence, where cycling is a popular mode of transport. The competitive landscape features brands like Garmin and Lezyne, which cater to both casual and professional cyclists. Local dynamics are characterized by a vibrant cycling community, with numerous events and races fostering interest in advanced cycling technology. The market is also influenced by a growing trend towards eco-friendly transportation solutions.

Spain : Cycling Popularity on the Rise

Key markets include Barcelona and Madrid, where cycling infrastructure is being developed. The competitive landscape features brands like Garmin and Wahoo Fitness, which are gaining popularity among urban cyclists. Local dynamics are influenced by a growing interest in cycling as a recreational activity, supported by community events and cycling clubs. The market is also seeing an influx of international brands, enhancing product availability and variety.

Rest of Europe : Varied Preferences Across Regions

Key markets include countries like the Netherlands, Belgium, and Scandinavia, where cycling is deeply ingrained in culture. The competitive landscape features a mix of local and international brands, including Polar and Cateye. Local dynamics vary significantly, with some regions focusing on recreational cycling while others emphasize competitive sports. The market is influenced by a strong community of cyclists and numerous cycling events, fostering interest in advanced cycling technology.