Sustainability Initiatives

Sustainability initiatives are becoming increasingly prominent in Europe, influencing the control valve market significantly. The European Union has set ambitious targets for reducing greenhouse gas emissions, which has led industries to adopt more sustainable practices. This shift necessitates the use of control valves that are energy-efficient and capable of handling alternative energy sources, such as biogas and hydrogen. The market for control valves designed for sustainable applications is expected to grow, with estimates suggesting a potential increase of 15% in demand for eco-friendly control valves by 2027. Additionally, industries are focusing on reducing water consumption and waste, further driving the need for innovative control valve solutions that support these sustainability goals. As companies align with environmental regulations, the control valve market is likely to see a transformation towards greener technologies.

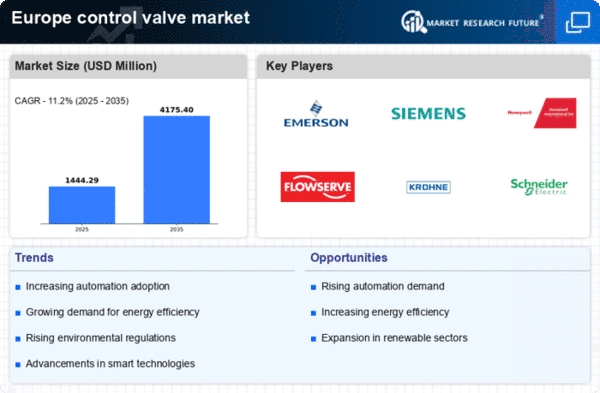

Rising Demand for Automation

The control valve market in Europe experiences a notable surge in demand due to the increasing trend towards automation across various industries. Automation enhances operational efficiency and reduces human error, which is particularly crucial in sectors such as oil and gas, water treatment, and manufacturing. According to recent data, the automation market in Europe is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth directly influences the control valve market, as automated systems require advanced control valves for precise flow regulation. Furthermore, the integration of smart technologies, such as IoT and AI, into control systems necessitates the use of sophisticated control valves, thereby driving market expansion. As industries strive for higher productivity and lower operational costs, the demand for advanced control valve solutions is likely to increase significantly.

Industrial Growth and Expansion

The control valve market in Europe is significantly influenced by the growth and expansion of various industrial sectors. Industries such as chemicals, pharmaceuticals, and food and beverage are experiencing robust growth, which in turn drives the demand for control valves. The chemical industry alone is projected to grow at a CAGR of around 4% through 2028, necessitating advanced control systems for process optimization. As production capacities increase, the need for reliable and efficient control valves becomes paramount to ensure safety and compliance with stringent regulations. Furthermore, the expansion of manufacturing facilities across Europe is likely to lead to increased investments in control valve technologies, as companies seek to enhance operational efficiency and reduce costs. This industrial growth presents a favorable environment for the control valve market to thrive.

Infrastructure Development Projects

Infrastructure development projects across Europe are a significant driver for the control valve market. Governments and private sectors are investing heavily in upgrading and expanding infrastructure, particularly in water supply, wastewater management, and energy sectors. For instance, the European Commission has allocated substantial funding for infrastructure improvements, with an estimated €1 trillion earmarked for various projects by 2030. This investment is expected to create a robust demand for control valves, as they are essential components in managing fluid flow in these systems. The ongoing modernization of aging infrastructure also necessitates the replacement of outdated control valves with more efficient and reliable options. Consequently, the control valve market is poised for growth as these infrastructure projects progress, providing opportunities for manufacturers to innovate and supply advanced solutions.

Technological Integration in Manufacturing

The integration of advanced technologies in manufacturing processes is a key driver for the control valve market in Europe. Industries are increasingly adopting Industry 4.0 principles, which emphasize automation, data exchange, and smart manufacturing. This technological shift necessitates the use of sophisticated control valves that can seamlessly integrate with digital systems for real-time monitoring and control. The market for smart control valves is expected to grow significantly, with projections indicating a potential increase of 20% by 2028. Additionally, the rise of predictive maintenance practices, enabled by IoT and data analytics, further enhances the demand for control valves that can provide accurate performance data. As manufacturers strive for operational excellence and enhanced productivity, the control valve market is likely to benefit from this technological integration.