Growing Focus on Personalization

Personalization is emerging as a critical driver within the commerce cloud market in Europe. As consumers become more discerning, they increasingly expect tailored shopping experiences that cater to their individual preferences. Businesses are responding by implementing commerce cloud solutions that utilize customer data to deliver personalized recommendations and targeted marketing campaigns. Research indicates that personalized experiences can lead to a 20% increase in customer engagement and a 10% boost in conversion rates. This growing emphasis on personalization is prompting companies to invest in advanced technologies that facilitate real-time data analysis and customer segmentation, thereby enhancing their competitive edge in the market.

Integration of Advanced Analytics

The integration of advanced analytics into commerce cloud solutions is becoming a pivotal driver in the European market. Businesses are increasingly leveraging data analytics to gain insights into consumer behavior, preferences, and purchasing patterns. This trend is particularly relevant as companies aim to optimize their marketing strategies and improve customer targeting. Recent studies suggest that organizations utilizing advanced analytics can enhance their sales performance by up to 15%. As a result, the commerce cloud market is evolving to incorporate sophisticated analytical tools that enable businesses to make data-driven decisions. This shift not only enhances operational efficiency but also fosters a more personalized shopping experience for consumers.

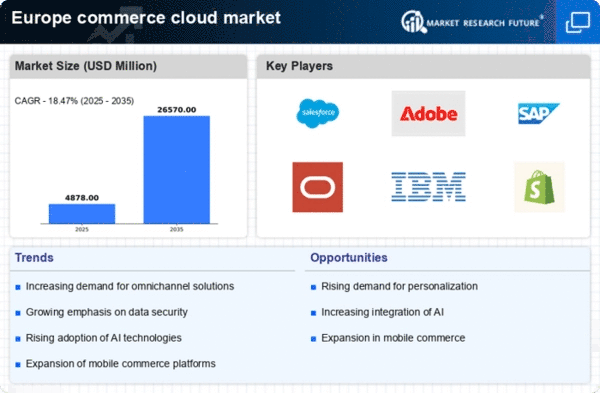

Rising Demand for Omnichannel Solutions

The commerce cloud market in Europe is experiencing a notable surge in demand for omnichannel solutions. Retailers are increasingly recognizing the necessity of providing a seamless shopping experience across various platforms, including online, mobile, and physical stores. This shift is driven by changing consumer preferences, as shoppers expect consistent interactions regardless of the channel. According to recent data, approximately 70% of consumers in Europe prefer brands that offer integrated shopping experiences. Consequently, businesses are investing in commerce cloud solutions that facilitate real-time inventory management and customer engagement across multiple touchpoints. This trend is likely to continue, as the commerce cloud market adapts to meet the evolving needs of consumers, ultimately enhancing customer satisfaction and loyalty.

Regulatory Compliance and Data Protection

The commerce cloud market in Europe is significantly influenced by the stringent regulatory landscape surrounding data protection and compliance. With the implementation of regulations such as the General Data Protection Regulation (GDPR), businesses are compelled to prioritize data security and privacy. This regulatory environment is driving demand for commerce cloud solutions that offer robust compliance features and secure data handling practices. Companies that fail to adhere to these regulations risk substantial fines and reputational damage. Consequently, the commerce cloud market is evolving to provide solutions that not only meet compliance requirements but also enhance consumer trust, thereby fostering long-term customer relationships.

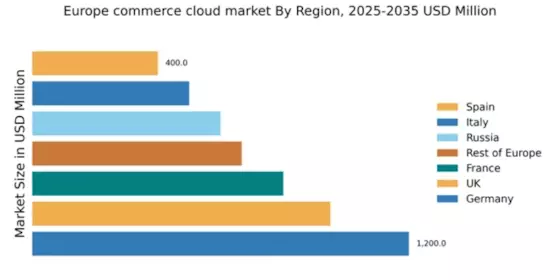

Expansion of E-commerce in Emerging Markets

The commerce cloud market in Europe is witnessing significant growth due to the expansion of e-commerce in emerging markets. Countries such as Poland, Hungary, and the Czech Republic are experiencing rapid digital transformation, leading to increased online shopping activities. Recent statistics indicate that e-commerce sales in these regions have grown by over 30% in the past year alone. This growth presents a lucrative opportunity for commerce cloud providers to offer tailored solutions that cater to the unique needs of these markets. As businesses in emerging economies seek to enhance their online presence, the demand for robust commerce cloud platforms is expected to rise, driving innovation and competition within the industry.