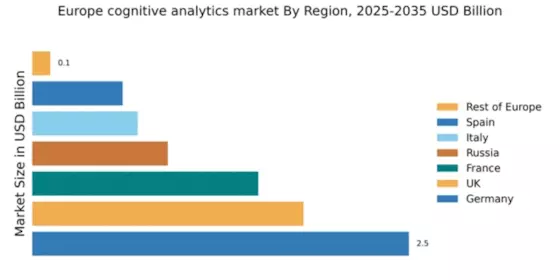

Germany : Strong Growth and Innovation Hub

Germany holds a dominant market share of 2.5 in the cognitive analytics sector, driven by robust industrialization and a strong emphasis on digital transformation. Key growth drivers include government initiatives promoting AI and data analytics, alongside increasing demand for data-driven decision-making across various sectors. The regulatory environment is supportive, with policies aimed at fostering innovation and investment in technology infrastructure, particularly in urban centers like Berlin and Munich.

UK : Innovation and Investment in Analytics

The UK boasts a market share of 1.8 in cognitive analytics, fueled by a vibrant tech ecosystem and significant investments in AI. Demand is particularly strong in finance, healthcare, and retail sectors, where organizations are leveraging analytics for enhanced customer insights and operational efficiency. The UK government has introduced various initiatives to support digital innovation, including funding for research and development in AI technologies.

France : Strong Government Support and Growth

France's cognitive analytics market, valued at 1.5, is characterized by strong government backing and a growing startup ecosystem. The French government has launched initiatives to promote AI research and development, which has spurred demand across sectors like automotive and manufacturing. The regulatory framework is evolving to support data privacy while encouraging innovation, making cities like Paris and Lyon key hubs for analytics.

Russia : Market Potential Amid Challenges

With a market share of 0.9, Russia is witnessing a gradual increase in the adoption of cognitive analytics, driven by the need for improved decision-making in various industries. Key growth drivers include government initiatives aimed at digital transformation and investments in technology infrastructure. However, regulatory challenges and economic factors may hinder rapid growth, particularly in regions like Moscow and St. Petersburg.

Italy : Focus on Manufacturing and Retail

Italy's cognitive analytics market, valued at 0.7, is experiencing growth, particularly in manufacturing and retail sectors. The demand for data analytics is being driven by the need for operational efficiency and enhanced customer experiences. Government initiatives aimed at digitalization and innovation are fostering a supportive environment, especially in industrial regions like Lombardy and Emilia-Romagna, where many key players are based.

Spain : Investment in Digital Transformation

Spain's cognitive analytics market, with a share of 0.6, is on the rise, driven by increasing investments in digital transformation across various sectors. The government has introduced policies to support innovation and technology adoption, particularly in cities like Madrid and Barcelona. The competitive landscape includes both local startups and international players, creating a dynamic environment for growth and collaboration.

Rest of Europe : Opportunities Across Various Nations

The Rest of Europe holds a modest market share of 0.12 in cognitive analytics, characterized by a fragmented landscape with varying levels of adoption. Countries like Belgium, Netherlands, and the Nordics are showing increasing interest in analytics, driven by local government initiatives and investments in technology. The competitive environment includes a mix of local and international players, each catering to specific regional needs and applications.