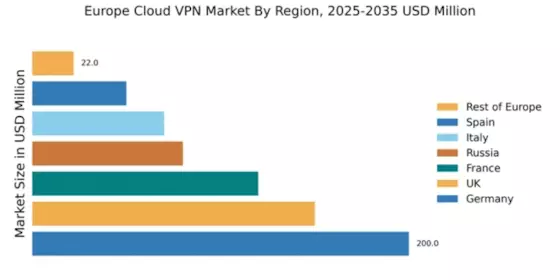

Germany : Strong Demand and Infrastructure Growth

Germany holds a commanding market share of 200.0, representing approximately 30.5% of the European cloud VPN market. Key growth drivers include a robust digital economy, increasing cybersecurity concerns, and a surge in remote work. The German government has implemented stringent data protection regulations, fostering a favorable environment for VPN adoption. Additionally, advancements in internet infrastructure and a high level of digital literacy contribute to rising demand for cloud VPN services.

UK : Diverse Applications and User Base

Key markets include London, Manchester, and Birmingham, where the competitive landscape features major players like NordVPN and ExpressVPN. The UK market is characterized by a diverse user base, including tech-savvy individuals and enterprises. Local dynamics favor innovation, with a growing emphasis on privacy and security in various sectors, including finance and e-commerce.

France : Focus on Privacy and Security

Key markets include Paris, Lyon, and Marseille, where major players like CyberGhost and NordVPN have established a strong presence. The competitive landscape is marked by a mix of local and international providers, fostering innovation and service diversity. The business environment is supportive, with a growing emphasis on cybersecurity across various sectors, including technology and finance.

Russia : Regulatory Challenges and Opportunities

Key markets include Moscow and St. Petersburg, where major players like NordVPN and IPVanish operate. The competitive landscape is influenced by local regulations, with a mix of domestic and international providers. The business environment is complex, with a focus on compliance and adaptation to regulatory changes. Industries such as media and technology are particularly reliant on VPN services for secure communications.

Italy : Rising Demand for Online Security

Key markets include Rome, Milan, and Naples, where major players like Surfshark and CyberGhost are gaining traction. The competitive landscape features a mix of local and international providers, fostering innovation and service diversity. The business environment is evolving, with a growing emphasis on cybersecurity across various sectors, including retail and finance.

Spain : Focus on Digital Privacy Solutions

Key markets include Madrid, Barcelona, and Valencia, where major players like NordVPN and Surfshark have established a presence. The competitive landscape is characterized by a mix of local and international providers, fostering innovation and service diversity. The business environment is supportive, with a growing emphasis on cybersecurity across various sectors, including technology and finance.

Rest of Europe : Varied Adoption and Regulatory Landscape

Key markets include countries like Belgium, Netherlands, and Switzerland, where major players like ProtonVPN and TunnelBear are gaining traction. The competitive landscape varies significantly, with a mix of local and international providers. The business environment is diverse, with different sectors, including finance and technology, increasingly relying on VPN services for secure communications.