Advancements in Streaming Technology

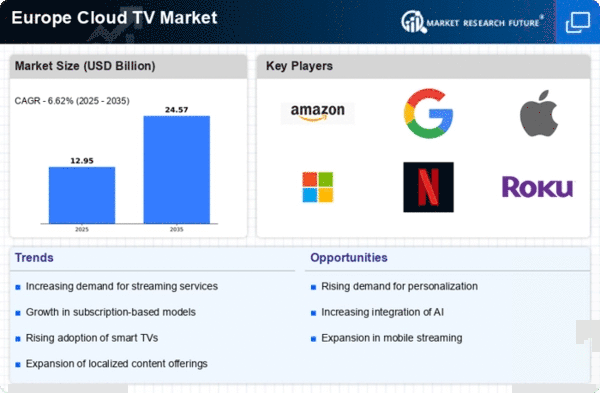

Technological advancements play a crucial role in shaping the cloud TV market in Europe. Innovations such as 5G connectivity and improved broadband infrastructure facilitate faster and more reliable streaming services. As a result, consumers are increasingly adopting cloud TV solutions that offer high-definition content without buffering issues. The cloud TV market is witnessing a shift towards 4K and even 8K streaming capabilities, which enhances viewer satisfaction. Furthermore, the integration of smart devices and Internet of Things (IoT) technology allows for a more interconnected viewing experience. This technological evolution is expected to contribute to a projected growth rate of 15% in the cloud TV market over the next few years.

Increasing Demand for On-Demand Content

The cloud TV market in Europe experiences a notable surge in demand for on-demand content. Consumers increasingly prefer the flexibility of accessing their favorite shows and movies at their convenience. This shift is reflected in the growing number of subscriptions to cloud TV services, which reportedly reached 50 million in 2025. The cloud TV market is adapting to this trend by enhancing content libraries and offering diverse genres to cater to varied tastes. As a result, service providers are investing heavily in cloud infrastructure to ensure seamless streaming experiences. This demand for on-demand content is likely to drive revenue growth in the cloud TV market, with projections indicating a potential increase of 20% in the next five years.

Regulatory Support for Digital Services

Regulatory frameworks in Europe are increasingly supportive of digital services, which positively impacts the cloud TV market. Governments are implementing policies that promote fair competition and protect consumer rights, thereby fostering a conducive environment for cloud TV services. This regulatory support encourages investment in cloud infrastructure and content development, which is essential for the growth of the market. Additionally, initiatives aimed at enhancing digital literacy among consumers are likely to expand the user base for cloud TV services. The cloud TV market is expected to benefit from these regulatory measures, with an anticipated growth rate of 12% in the coming years as more consumers gain access to digital content.

Rising Competition Among Service Providers

The cloud TV market in Europe is characterized by intense competition among various service providers. Established players and new entrants are vying for market share, leading to innovative offerings and competitive pricing strategies. This competitive landscape encourages providers to enhance their service quality and expand their content libraries. As a result, consumers benefit from a wider array of choices, including niche content that caters to specific interests. The cloud TV market is projected to see a 10% increase in subscriber growth as providers strive to differentiate themselves. This competition not only drives down prices but also fosters innovation, ultimately benefiting the end-users.

Growing Interest in Original Content Production

The cloud TV market in Europe is witnessing a growing interest in original content production. Streaming platforms are increasingly investing in creating exclusive shows and films to attract and retain subscribers. This trend is evident as major players allocate substantial budgets for original programming, with estimates suggesting that spending could reach €5 billion by 2026. The cloud TV market is thus becoming a battleground for original content, as providers seek to establish their unique identities. This focus on original content not only enhances viewer engagement but also contributes to the overall growth of the market, with projections indicating a potential increase in subscriptions by 25% over the next few years.