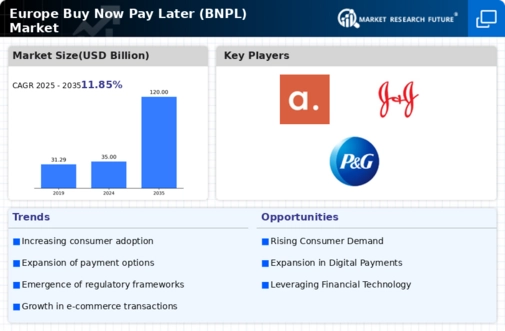

Europe's Buy Now Pay Later (BNPL) market is currently experiencing numerous significant trends that are influencing its growth and adoption. A significant market driver is the growing preference for flexible payment options among consumers, particularly those in the younger demographic. The emergence of e-commerce has attracted consumers in countries such as the UK, France, and Germany to BNPL services, which enable them to effectively manage their finances.

The expanding digitalization of financial services across Europe is further supporting this shift, resulting in an increase in partnerships between retailers and BNPL providers. Opportunities in the European BNPL market are arising as small and medium-sized enterprises (SMEs) acknowledge the potential of providing flexible payment options to attract and retain consumers.

In regions such as Scandinavia, innovative businesses are entering the market to offer customized solutions that cater to the specific requirements of local consumers. Additionally, as European legislation continues to develop to oversee fintech operations, companies may enhance consumer confidence, thereby promoting the adoption of BNPL services.

Recent trends suggest that consumers are increasingly favoring BNPL options for both in-store and online purchases, with retail sectors such as electronics and fashion leading the way. Businesses are incorporating these solutions into their offerings to improve the consumer experience and increase sales. In addition, the incorporation of responsible lending practices is becoming a focal point, as providers prioritize transparency and consumer protection to establish trust.

Overall, the European BNPL market is adjusting to evolving consumer behaviors and fostering a conducive environment for the development of sustainable payment solutions and innovation.

Europe Buy Now Pay Later Market (BNPL) Market Drivers

Increasing Adoption of Digital Payment Solutions

The Europe Buy Now Pay Later Market (BNPL) Market Industry is experiencing significant growth driven by the increasing adoption of digital payment solutions among consumers and businesses. A survey conducted by the European Payment Council highlights that approximately 60% of online shoppers in Europe prefer using digital payment methods over cash, which has led to a surge in the demand for BNPL services.

Established organizations such as Klarna and Afterpay, which have gained widespread acceptance in various European countries, further cater to this growing trend.The convenience and flexibility provided by BNPL options have influenced both consumer behavior and retailer offerings, making it a crucial driver for market expansion.

Furthermore, it has been noted that in regions where digital payment infrastructure is enhanced, there's an approximate 25% increase in conversion rates for retailers offering BNPL options. As more players enter the market and traditional financial institutions adopt BNPL models, the overall market prospects in Europe continue to improve.

Shift Towards Online Shopping

The trend of shifting towards online shopping represents another significant driver for the Europe Buy Now Pay Later Market (BNPL) Market Industry. The COVID-19 pandemic has accelerated this transition, leading to a reported increase of over 30% in e-commerce sales in many European countries according to Eurostat.

With this shift, consumers are increasingly utilizing BNPL options as a payment method to manage their budgets more effectively. As e-commerce giants like Amazon and local retailers adopt and integrate BNPL offerings, the market is seeing positive momentum.

The growing preference for online shopping coupled with the ease of buying now and paying later has created an environment where this market can thrive.

Consumer Demand for Flexible Payment Solutions

In Europe's competitive retail landscape, consumer demand for flexibility in payment solutions is a prominent driver for the Buy Now Pay Later BNPL Market Industry. A study from the European Banking Authority revealed that approximately 70% of consumers express a desire for more flexible payment options, especially for larger purchases.

Organizations such as PayPal and Zilch are responding to this demand by integrating BNPL options at the checkout points.This demand for flexibility not only supports individual consumer preferences but also aligns with retailers’ strategies to increase average order values and repeat purchases.

Companies adopting BNPL services are experiencing up to a 50% increase in customer retention, highlighting its importance in market expansion.

Europe Buy Now Pay Later Market (BNPL) Market