Rising Cyber Threats

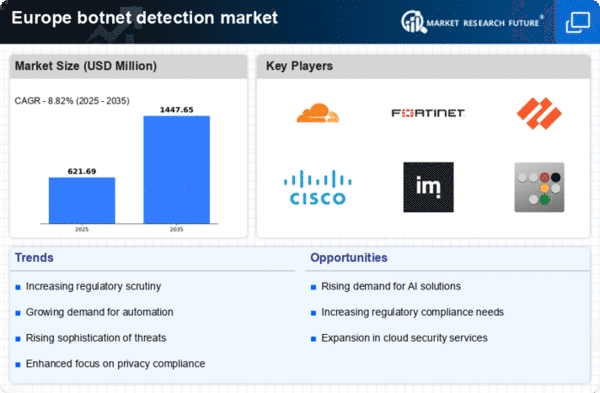

The botnet detection market in Europe is experiencing growth due to the increasing frequency and sophistication of cyber threats. Cybercriminals are leveraging advanced techniques to create and manage botnets, which poses significant risks to organizations. In 2025, it is estimated that cybercrime will cost European businesses over €200 billion annually. This alarming trend compels organizations to invest in robust botnet detection solutions to safeguard their digital assets. The urgency to protect sensitive data and maintain operational integrity drives demand for innovative detection technologies. As a result, the botnet detection market is projected to expand, with a projected CAGR of 15% over the next five years, reflecting the critical need for enhanced security measures.

Increased Cloud Adoption

The rapid adoption of cloud computing services across Europe is reshaping the botnet detection market. As organizations migrate their operations to the cloud, they face new security challenges, including the risk of botnet attacks targeting cloud infrastructure. In 2025, it is anticipated that over 70% of European enterprises will utilize cloud services, creating a pressing need for effective botnet detection solutions tailored for cloud environments. This shift is likely to drive innovation in detection technologies, as vendors develop solutions that can seamlessly integrate with cloud platforms. the botnet detection market is projected to benefit from this trend, with a projected growth rate of 12% annually as organizations seek to protect their cloud assets from emerging threats.

Growing Awareness of Cybersecurity

There is a notable increase in awareness regarding cybersecurity among businesses in Europe, which is positively impacting the botnet detection market. Organizations are recognizing the importance of proactive measures to combat cyber threats, leading to heightened investments in security solutions. Surveys indicate that approximately 60% of European companies plan to increase their cybersecurity budgets in 2025, with a significant portion allocated to botnet detection technologies. This growing awareness is fostering a culture of security within organizations, prompting them to prioritize the implementation of advanced detection systems. As a result, the botnet detection market is projected to experience robust growth, driven by the collective efforts of businesses to enhance their cybersecurity frameworks.

Regulatory Compliance Requirements

The evolving regulatory landscape in Europe significantly influences the botnet detection market. With the implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), organizations are mandated to adopt comprehensive security measures. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. Consequently, businesses are increasingly prioritizing botnet detection solutions to ensure compliance and mitigate potential legal repercussions. This regulatory pressure is expected to drive market growth, as organizations seek to align their security strategies with legal requirements. The botnet detection market is projected to witness a surge in demand as companies strive to enhance their cybersecurity posture.

Technological Advancements in Detection Solutions

the botnet detection market is projected to be propelled by continuous technological advancements in detection solutions. Innovations such as machine learning, artificial intelligence, and behavioral analytics are enhancing the capabilities of botnet detection systems. These technologies enable organizations to identify and mitigate threats more effectively, reducing response times and improving overall security posture. In 2025, it is projected that the market for AI-driven security solutions will reach €10 billion in Europe, indicating a strong trend towards integrating advanced technologies in cybersecurity. As organizations seek to leverage these advancements, the demand for sophisticated botnet detection solutions is expected to rise, further fueling market growth.