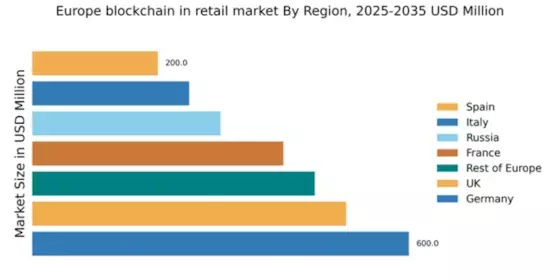

Germany : Innovation and Infrastructure Drive Growth

Key markets include Berlin, Munich, and Frankfurt, where tech hubs and startups thrive. The competitive landscape features major players like SAP and IBM, alongside emerging local firms. The business environment is characterized by a strong emphasis on innovation, with applications in logistics, supply chain management, and payment systems. The integration of blockchain in retail is expected to streamline operations and enhance customer experiences.

UK : Strong Investment and Innovation Ecosystem

London is the primary market, with significant activity in Manchester and Edinburgh. The competitive landscape includes major players like IBM and Oracle, alongside numerous startups. The local market dynamics are characterized by a collaborative ecosystem, where businesses leverage blockchain for applications in supply chain transparency, loyalty programs, and secure payments. The UK is poised for continued growth in blockchain adoption across various retail sectors.

France : Government Support Fuels Growth

Paris is the key market, with Lyon and Marseille also showing significant potential. The competitive landscape features major players like SAP and local startups. The business environment is dynamic, with a focus on applications in supply chain management, product authenticity, and customer engagement. France's commitment to fostering innovation positions it as a leader in blockchain adoption within the retail sector.

Russia : Potential for Rapid Growth

Moscow and St. Petersburg are the primary markets, with a growing number of tech startups emerging. The competitive landscape includes both local and international players, with a focus on applications in supply chain transparency and digital payments. The business environment is improving, with increasing collaboration between government and private sectors to drive blockchain adoption in retail.

Italy : Cultural Heritage Meets Innovation

Key markets include Milan, Rome, and Florence, where luxury brands are exploring blockchain for product authenticity. The competitive landscape features major players like IBM and local firms. The business environment is characterized by a focus on applications in luxury goods, food traceability, and supply chain management. Italy's unique market dynamics position it well for blockchain adoption in retail.

Spain : Innovation in Consumer Engagement

Barcelona and Madrid are the primary markets, with a vibrant startup ecosystem. The competitive landscape includes major players like Oracle and local innovators. The business environment is dynamic, with applications in customer loyalty programs, supply chain transparency, and secure payments. Spain's focus on innovation positions it for significant growth in blockchain adoption within retail.

Rest of Europe : Regional Variations Drive Innovation

Key markets include the Nordics, Benelux, and Eastern Europe, each with unique characteristics. The competitive landscape features a mix of local and international players, with applications in various sectors such as logistics, e-commerce, and payment systems. The diverse business environments across the region create opportunities for tailored blockchain solutions in retail.