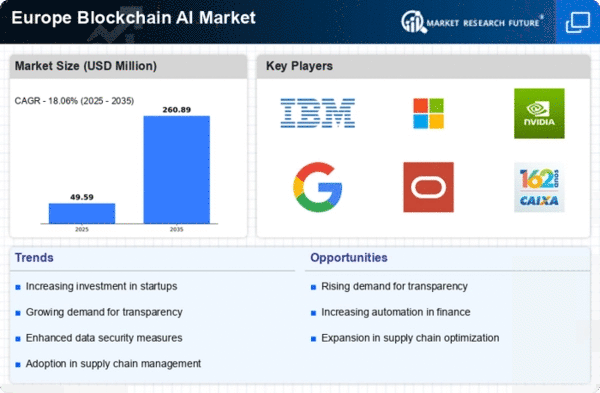

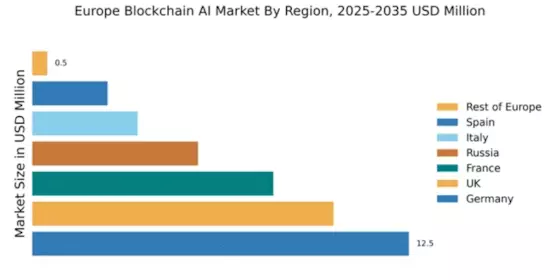

Germany : Strong Market Share and Growth

Germany holds a commanding 12.5% market share in the European blockchain AI sector, valued at approximately €3.5 billion. Key growth drivers include a robust industrial base, significant investments in R&D, and a favorable regulatory environment that encourages innovation. The German government has initiated several programs to support digital transformation, enhancing infrastructure and fostering collaboration between tech firms and academia. Demand for blockchain AI solutions is surging, particularly in finance and manufacturing sectors, as companies seek to optimize operations and enhance security.

UK : Innovation and Investment Hub

The UK commands a 10.0% market share in the blockchain AI market, valued at around €2.8 billion. The growth is driven by a vibrant startup ecosystem, substantial venture capital investments, and a strong focus on fintech applications. The UK government has implemented supportive policies, including the Financial Services Bill, which promotes the use of blockchain in financial services. Demand is particularly high in London and Manchester, where tech clusters are thriving, and businesses are increasingly adopting AI-driven blockchain solutions to enhance efficiency and transparency.

France : Strong Government Support and Innovation

France holds an 8.0% market share in the blockchain AI market, valued at approximately €2.2 billion. The French government has launched initiatives like the Blockchain Plan, aimed at fostering innovation and attracting investment in digital technologies. Key growth drivers include a strong emphasis on research and development, particularly in Paris and Lyon, where numerous tech startups are emerging. The demand for blockchain AI solutions is growing in sectors such as logistics and healthcare, as companies seek to improve traceability and data security.

Russia : Strategic Investments and Development

Russia accounts for a 5.5% market share in the blockchain AI market, valued at around €1.5 billion. The growth is fueled by government initiatives aimed at digital transformation and significant investments in technology infrastructure. The Russian government has introduced regulations to support blockchain technology, particularly in finance and public services. Key cities like Moscow and St. Petersburg are becoming hubs for blockchain innovation, with local startups and established firms collaborating to develop AI-driven solutions for various industries.

Italy : Cultural Heritage Meets Technology

Italy has a 3.5% market share in the blockchain AI market, valued at approximately €1 billion. The growth is driven by increasing interest in digital transformation across various sectors, including art and fashion, where blockchain is used for provenance tracking. The Italian government is promoting initiatives to support innovation, particularly in regions like Lombardy and Emilia-Romagna. The competitive landscape features both local startups and international players, with a focus on enhancing supply chain transparency and improving customer engagement through AI-driven solutions.

Spain : Focus on Innovation and Collaboration

Spain holds a 2.5% market share in the blockchain AI market, valued at around €700 million. The growth is supported by government initiatives aimed at fostering innovation, particularly in Barcelona and Madrid, where tech ecosystems are flourishing. Demand for blockchain AI solutions is rising in sectors such as tourism and real estate, as companies seek to enhance customer experiences and streamline operations. The competitive landscape includes a mix of local startups and established firms, with a strong emphasis on collaboration between academia and industry.

Rest of Europe : Emerging Opportunities Across Regions

The Rest of Europe accounts for a mere 0.5% market share in the blockchain AI market, valued at approximately €140 million. This fragmented market presents unique opportunities for growth, driven by localized initiatives and emerging tech hubs. Countries like Belgium and the Netherlands are beginning to invest in blockchain technology, supported by favorable regulatory frameworks. The competitive landscape is characterized by small startups and niche players focusing on specific applications, such as supply chain management and digital identity verification.