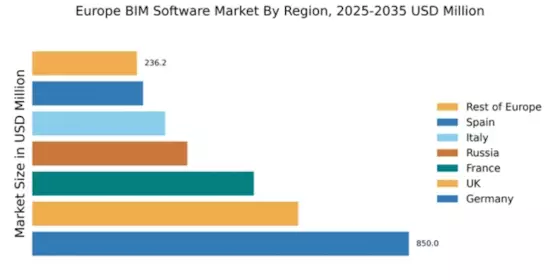

Germany : Strong Growth and Innovation Hub

Key markets include cities like Berlin, Munich, and Frankfurt, which are witnessing significant construction activities. The competitive landscape features major players such as Nemetschek, Siemens, and Autodesk, all vying for market share. The local business environment is characterized by a strong focus on innovation and collaboration, particularly in the automotive and manufacturing sectors, where BIM applications are increasingly adopted for efficiency.

UK : Innovation Meets Regulatory Support

Key markets include London, Manchester, and Birmingham, where significant infrastructure projects are underway. The competitive landscape features players like AVEVA and Autodesk, alongside local firms. The UK market is characterized by a collaborative approach among stakeholders, with a growing emphasis on integrating BIM into project management and delivery processes.

France : Sustainability and Innovation Focus

Key markets include Paris, Lyon, and Marseille, where urban development projects are thriving. Major players like Dassault Systèmes and Graphisoft are prominent in the competitive landscape. The French market is characterized by a strong emphasis on innovation and collaboration, particularly in the public sector, where BIM is increasingly integrated into planning and execution.

Russia : Growth Amidst Challenges

Key markets include Moscow and St. Petersburg, where significant construction projects are underway. The competitive landscape features both local and international players, with Autodesk and Bentley Systems having a notable presence. The Russian market is characterized by a growing interest in BIM technologies, particularly in the public sector, where efficiency and transparency are becoming priorities.

Italy : Cultural Heritage Meets Modernization

Key markets include Rome, Milan, and Turin, where historical preservation projects are prominent. The competitive landscape features players like Autodesk and local firms. The Italian market is characterized by a unique blend of tradition and innovation, with BIM applications increasingly used in restoration projects and urban planning.

Spain : Infrastructure Development and Innovation

Key markets include Madrid and Barcelona, where major infrastructure projects are in progress. The competitive landscape features players like Autodesk and local firms. The Spanish market is characterized by a collaborative approach among stakeholders, with a growing emphasis on integrating BIM into project management and delivery processes.

Rest of Europe : Varied Markets with Unique Challenges

Key markets include countries like Sweden, Norway, and the Netherlands, where BIM adoption is gaining traction. The competitive landscape features a mix of local and international players, with a focus on innovation and collaboration. The market dynamics are influenced by varying levels of regulatory support and industry readiness, creating unique opportunities and challenges.