Rise of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is transforming the Europe Automotive Sensors Market. As automakers pivot towards sustainable mobility solutions, the need for specialized sensors in electric and hybrid vehicles is becoming increasingly pronounced. These vehicles require sensors for battery management systems, thermal management, and energy efficiency monitoring. According to recent data, the electric vehicle market in Europe is expected to reach a penetration rate of over 30% by 2030. This shift not only drives demand for automotive sensors but also encourages innovation in sensor technology to meet the unique requirements of electric drivetrains. Thus, the Europe Automotive Sensors Market is poised for substantial growth as manufacturers adapt to this evolving landscape.

Growth of Connected Vehicle Technologies

The growth of connected vehicle technologies is a significant driver for the Europe Automotive Sensors Market. With the advent of the Internet of Things (IoT), vehicles are becoming increasingly interconnected, necessitating a wide array of sensors for data collection and communication. These sensors facilitate vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, enhancing safety and traffic management. The European connected car market is projected to expand rapidly, with estimates indicating a market size exceeding 100 billion euros by 2025. This expansion is likely to spur demand for advanced sensors that can support real-time data exchange and improve overall vehicle performance. Consequently, the Europe Automotive Sensors Market is expected to benefit from this trend as manufacturers invest in sensor technologies that enable connectivity.

Increasing Focus on Vehicle Safety Regulations

Increasing focus on vehicle safety regulations is a crucial driver for the Europe Automotive Sensors Market. Regulatory bodies across Europe are implementing stringent safety standards that require the incorporation of advanced sensor technologies in vehicles. These regulations aim to reduce road accidents and enhance overall vehicle safety. For instance, the European Union has mandated that all new vehicles must be equipped with certain safety features, which directly influences the demand for sensors such as collision detection and stability control systems. As a result, the Europe Automotive Sensors Market is likely to see a surge in sensor production to comply with these regulations, thereby fostering innovation and technological advancements in the sector.

Technological Advancements in Sensor Technologies

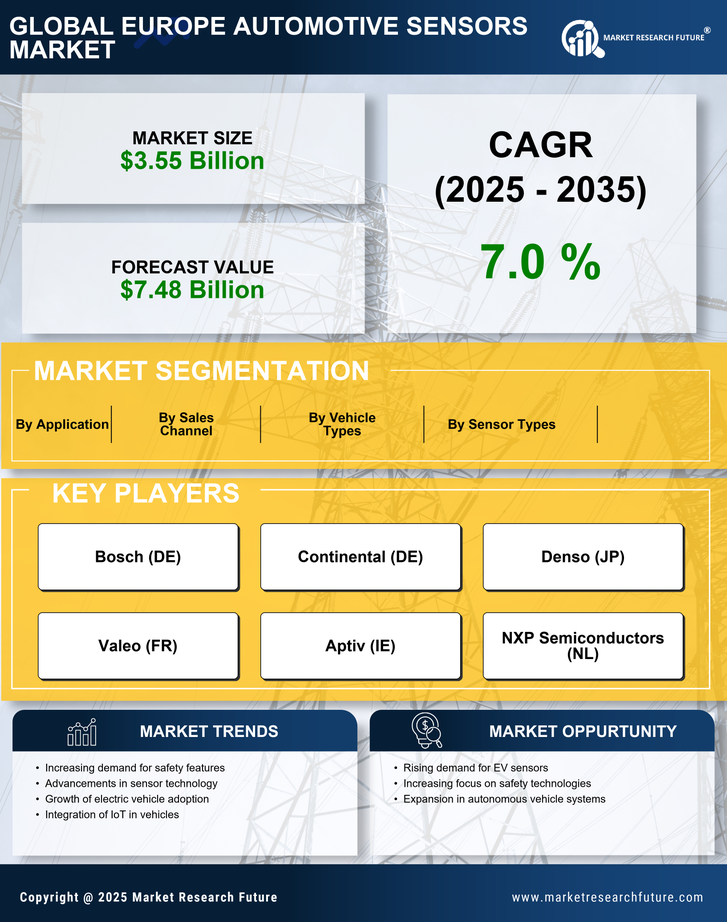

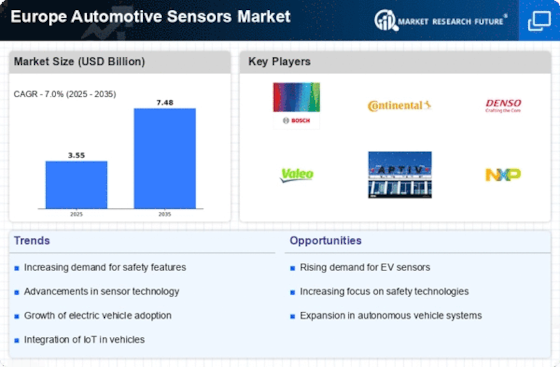

Technological advancements in sensor technologies are driving the evolution of the Europe Automotive Sensors Market. Innovations such as miniaturization, improved accuracy, and enhanced sensitivity are enabling the development of more sophisticated sensors. These advancements are crucial for applications in autonomous driving, where high-performance sensors are required for safe navigation and obstacle detection. The market for automotive sensors is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by these technological improvements. As manufacturers strive to enhance vehicle performance and safety, the Europe Automotive Sensors Market is likely to witness a proliferation of cutting-edge sensor solutions that cater to the demands of modern vehicles.

Integration of Advanced Driver Assistance Systems (ADAS)

The integration of Advanced Driver Assistance Systems (ADAS) is a pivotal driver for the Europe Automotive Sensors Market. As vehicle manufacturers increasingly adopt ADAS technologies, the demand for various sensors, such as radar, lidar, and cameras, is surging. These sensors are essential for functionalities like lane-keeping assistance, adaptive cruise control, and automatic emergency braking. In Europe, the market for ADAS is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This growth is largely attributed to stringent safety regulations and consumer demand for enhanced vehicle safety features. Consequently, the Europe Automotive Sensors Market is likely to experience a corresponding increase in sensor deployment to support these advanced systems.