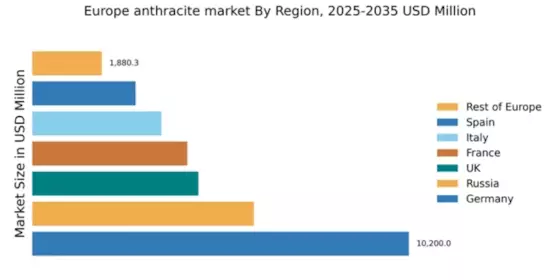

Germany : Strong Demand and Infrastructure Growth

Germany holds a dominant position in the European anthracite market, accounting for approximately 30% of the total market share with a value of $10,200.0 million. Key growth drivers include robust industrial demand, particularly in steel production and energy generation. Government initiatives aimed at reducing carbon emissions are also influencing consumption patterns, pushing industries towards cleaner alternatives while still relying on anthracite for its efficiency. Infrastructure development, including transportation and logistics, supports market growth.

UK : Transitioning Energy Landscape and Regulations

The UK anthracite market is valued at $4,500.0 million, representing about 15% of the European market. The demand is driven by the ongoing transition towards cleaner energy sources, with anthracite still playing a role in specific industrial applications. Regulatory policies, including the UK’s commitment to phase out unabated coal by 2024, are shaping consumption trends. The market is also influenced by investments in renewable energy infrastructure, which are gradually replacing traditional coal usage.

France : Diverse Applications and Regulatory Support

France's anthracite market is valued at $4,200.0 million, capturing around 14% of the European market. The growth is supported by diverse applications in metallurgy and energy sectors. Demand trends indicate a steady consumption pattern, bolstered by government policies promoting cleaner energy while still utilizing anthracite for its high calorific value. Infrastructure improvements in transportation and logistics are facilitating market access and distribution.

Russia : Key Player in Global Supply Chain

Russia's anthracite market is valued at $6,000.0 million, representing about 20% of the European market. The country is a significant player in the global supply chain, driven by high production capacities and export potential. Demand is primarily from the steel and energy sectors, with government support for mining operations. Regulatory frameworks are evolving to balance economic growth with environmental considerations, impacting consumption patterns.

Italy : Industrial Demand and Regulatory Challenges

Italy's anthracite market is valued at $3,500.0 million, accounting for approximately 11% of the European market. The growth is driven by industrial demand, particularly in manufacturing and energy sectors. However, regulatory challenges related to environmental policies are influencing consumption trends. The Italian government is promoting cleaner energy solutions, which may impact future anthracite usage. Infrastructure development is crucial for enhancing market access.

Spain : Industrial Applications and Market Dynamics

Spain's anthracite market is valued at $2,800.0 million, representing about 9% of the European market. The demand is primarily driven by industrial applications, particularly in metallurgy and energy generation. Local market dynamics are influenced by regulatory policies aimed at reducing carbon emissions, pushing industries to seek cleaner alternatives. However, anthracite remains a key component in energy production, supported by ongoing infrastructure improvements.

Rest of Europe : Varied Demand and Regulatory Frameworks

The Rest of Europe anthracite market is valued at $1,880.3 million, capturing around 6% of the total European market. This segment includes various countries with diverse demand patterns influenced by local industries and regulatory frameworks. Growth drivers vary significantly, with some regions focusing on energy generation while others emphasize industrial applications. The competitive landscape is fragmented, with several local players and varying levels of government support for coal usage.