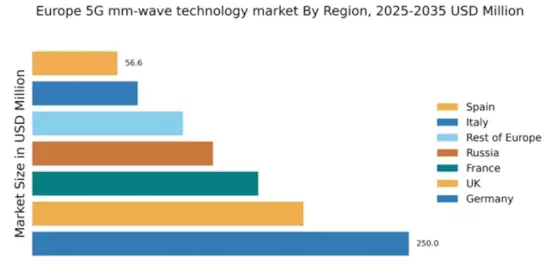

Germany : Strong Infrastructure and Innovation Hub

Key markets include Berlin, Munich, and Frankfurt, where major telecom operators like Deutsche Telekom and Vodafone are actively expanding their 5G networks. The competitive landscape features significant players such as Nokia and Ericsson, who are collaborating with local firms to enhance service delivery. The business environment is characterized by a strong emphasis on technology adoption in industries like automotive and logistics, making Germany a pivotal player in the European 5G landscape.

UK : Innovative Solutions and Competitive Edge

Key markets include London, Manchester, and Birmingham, where major players like BT and Vodafone are leading the charge in 5G deployment. The competitive landscape is vibrant, with companies like Huawei and Ericsson also making significant inroads. The UK’s business environment is conducive to tech startups, particularly in sectors like fintech and healthcare, which are leveraging 5G for enhanced service delivery.

France : Government Support and Market Growth

Key markets include Paris, Lyon, and Marseille, where major telecom operators like Orange and SFR are actively expanding their 5G networks. The competitive landscape features significant players such as Nokia and Ericsson, who are collaborating with local firms to enhance service delivery. The business environment is characterized by a strong emphasis on technology adoption in industries like automotive and logistics, making France a pivotal player in the European 5G landscape.

Russia : Government Initiatives and Infrastructure Growth

Key markets include Moscow and St. Petersburg, where major players like MTS and MegaFon are leading the 5G rollout. The competitive landscape is evolving, with local firms collaborating with international players like Huawei and Ericsson. The business environment is marked by a focus on technology adoption in sectors such as energy and transportation, positioning Russia as a growing player in the European 5G market.

Italy : Investment and Innovation Drive Market

Key markets include Milan, Rome, and Turin, where major telecom operators like TIM and Vodafone are actively expanding their 5G networks. The competitive landscape features significant players such as Ericsson and Nokia, who are collaborating with local firms to enhance service delivery. The business environment is characterized by a strong emphasis on technology adoption in industries like manufacturing and logistics, making Italy a pivotal player in the European 5G landscape.

Spain : Government Support and Market Dynamics

Key markets include Madrid and Barcelona, where major telecom operators like Telefonica and Vodafone are actively expanding their 5G networks. The competitive landscape features significant players such as Nokia and Ericsson, who are collaborating with local firms to enhance service delivery. The business environment is characterized by a strong emphasis on technology adoption in industries like automotive and logistics, making Spain a pivotal player in the European 5G landscape.

Rest of Europe : Regional Variations and Opportunities

Key markets include cities across Scandinavia, the Benelux countries, and Eastern Europe, where major players like Ericsson and Nokia are establishing a presence. The competitive landscape is diverse, with local firms collaborating with international players to enhance service delivery. The business environment is characterized by a focus on technology adoption in various sectors, making the Rest of Europe a dynamic player in the European 5G market.