Germany : Innovation Drives German Software Growth

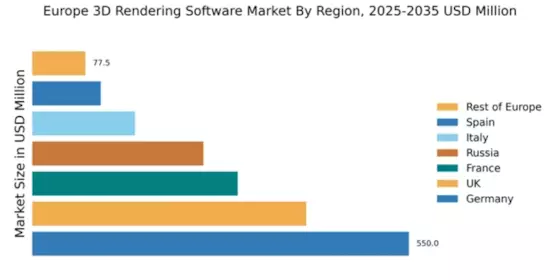

Germany holds a dominant position in the European 3D rendering software market, with a value of $550.0 million, accounting for approximately 35% of the total market share. Key growth drivers include a robust manufacturing sector, increasing demand for architectural visualization, and advancements in gaming technology. Government initiatives promoting digital transformation and investment in tech infrastructure further bolster market growth. The country’s strong industrial base supports a high consumption rate of rendering software, particularly in automotive and engineering sectors.

UK : Creative Industries Fueling Demand

The UK 3D rendering software market is valued at $400.0 million, representing about 25% of the European market. The growth is driven by the thriving creative industries, including film, gaming, and advertising, which increasingly rely on high-quality rendering solutions. The UK government has implemented favorable tax incentives for the creative sector, enhancing investment in technology. Additionally, the rise of virtual reality applications is shaping consumption patterns, leading to increased demand for sophisticated rendering tools.

France : Cultural Heritage Meets Technology

France's 3D rendering software market is valued at $300.0 million, capturing around 19% of the European market. The growth is fueled by the country's rich cultural heritage and a strong focus on the arts, which drives demand for high-quality visualizations in architecture and design. Government support for digital innovation and cultural projects enhances market potential. The increasing use of 3D rendering in education and training sectors also contributes to rising consumption.

Russia : Diverse Applications in Various Sectors

Russia's 3D rendering software market is valued at $250.0 million, accounting for about 16% of the European market. Key growth drivers include the expanding gaming industry and increasing adoption of 3D technologies in construction and manufacturing. However, regulatory challenges and economic fluctuations pose risks to market stability. The government is promoting digital initiatives, which may enhance infrastructure and support local developers, fostering a more competitive environment.

Italy : Art and Technology Converge

Italy's 3D rendering software market is valued at $150.0 million, representing about 9% of the European market. The growth is driven by the country's strong design and fashion industries, which increasingly utilize 3D rendering for product visualization and marketing. Government initiatives aimed at supporting innovation in the creative sector are also contributing to market expansion. The demand for rendering software is particularly high in cities like Milan and Florence, known for their design excellence.

Spain : Emerging Market with Potential

Spain's 3D rendering software market is valued at $100.0 million, making up about 6% of the European market. The growth is driven by increasing interest in digital content creation and the gaming industry. Government support for technology startups and digital innovation is fostering a conducive environment for market growth. Cities like Barcelona and Madrid are becoming key hubs for creative industries, enhancing demand for advanced rendering solutions.

Rest of Europe : Fragmented Landscape of Opportunities

The Rest of Europe accounts for a 3D rendering software market valued at $77.5 million, representing about 5% of the total market. This sub-region includes a mix of smaller markets with unique demands, driven by local industries such as architecture, gaming, and education. Regulatory frameworks vary significantly, impacting market dynamics. Countries like the Netherlands and Belgium are emerging as key players, with local firms innovating in rendering technologies to meet specific regional needs.