- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

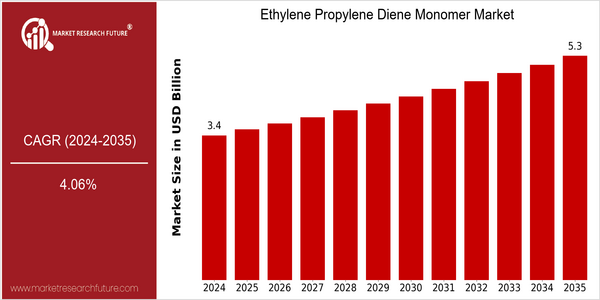

Ethylene Propylene Diene Monomer Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 3.42 Billion |

| 2035 | USD 5.3 Billion |

| CAGR (2025-2035) | 4.06 % |

Note – Market size depicts the revenue generated over the financial year

Ethylene propylene diene monomer (EPDM) market is expected to grow steadily, with a current market size of $ 3,423,907,500 in 2024, and is projected to reach $ 5,299,800,000 by 2035. The CAGR from 2025 to 2035 is 4.06%, indicating that the demand for EPDM in various applications is still high. The use of EPDM in the construction, electrical and automobile industries is expected to be the main driving force for the development of the market, as these industries need to use materials with high wear resistance, weather resistance and flexibility. In addition, with the increasing demand for green and low-carbon materials, EPDM, which has lower carbon emissions compared to traditional rubber, is also expected to be in great demand. Strategic players in the EPDM market, such as ExxonMobil, Lanxess and Kumho Polychem, are actively involved in the market, and have established long-term strategic cooperative relations with new technology. , in order to increase their market share and meet the needs of consumers. This will greatly promote the development of the market in the future.

Regional Deep Dive

EPDM is a derivative of ethylene and propylene. It is a polarizing chemical which is used in the manufacture of a variety of rubber goods. The North American market is buoyed by the strong performance of the automobile industry and the rising demand for high-quality materials. Europe, with its strong focus on innovation and the environment, is also booming, especially in the building and automobile industries. The rapid industrialization and urbanization of the Asia-Pacific region is generating high demand for EPDM in a wide variety of applications. Middle East and Africa (MEA) are growing mainly due to the expansion of their petrochemical industries, while Latin America is gradually gaining ground, with its growing investment in the automobile and building industries.

North America

- The North American EPDM market is largely influenced by the auto industry. The ExxonMobil and Lanxess companies are investing in EPDM production to enhance the performance and to improve the environment.

- The new regulations on the reduction of carbon dioxide emissions have prompted manufacturers to produce more eco-friendly EPDM products. At the same time, consumers are increasingly demanding products that are eco-friendly.

- The rise of electric vehicles (EVs) is creating new opportunities for EPDM in the batteries and insulating parts of the vehicles, with companies such as Tesla and Ford developing new applications.

Europe

- The European market is characterized by the use of recycled materials in the production of EPDM, which has led to the development of new products such as Kraton and Synthos.

- The ever-tightening legislation in Europe is pushing manufacturers to produce their products in an increasingly sustainable way and to reduce the environmental impact of the production of EPDM.

- The car industry in Europe is rapidly adopting the lightweight and durable properties of EPDM. The great car manufacturers are already introducing it into their car designs.

Asia-Pacific

- Asia-Pacific, especially China and India, is undergoing rapid urbanization. This is reflected in a growing demand for EPDM for use in construction and automobile applications.

- The main chemical companies, such as LGC and Sinopec, are expanding their production capacity of EPDM to meet the increasing regional demand.

- Moreover, government initiatives to promote the development of infrastructure are expected to further increase the demand for EPDM in the construction industry and in the automobile industry.

MEA

- EPDM is a synthetic rubber, with a long history and wide applications. The Middle East and Africa region is seeing growth in the EPDM market, mainly because of the expansion of the petrochemical industry, with companies such as SABIC and Borouge investing in new production plants.

- The new laws, which aim at promoting domestic industry and reducing imports, are fostering the development of domestic EPDM production capacity.

- In the region of the Middle East, the development of solar energy projects has created new markets for EPDM in the manufacture of solar cells and in the production of insulating materials.

Latin America

- Latin America is gradually increasing its share of the EPDM market, mainly on the strength of investments in public works, especially in Brazil and Mexico, which are expected to boost demand.

- The quality and performance of EPDM in the hands of local manufacturers are being improved, with Braskem leading the way.

- Government initiatives to promote the auto industry in the region will also create new opportunities for the use of epdm in vehicle production.

Did You Know?

“It is known for its superior resistance to heat, ozone, and weathering, which makes it the preferred material for roofing and automobile gaskets.” — American Chemistry Council

Segmental Market Size

EPDM is a major part of the synthetic rubber market and is currently experiencing strong growth because of its versatility and performance characteristics. The growing demand for durable materials in the automotive industry and the increasing use of EPDM in construction for roofing and sealing are the main drivers for the market. In addition, the trend towards more sustainable materials is driving the demand for EPDM, which is known for its resistance to heat, ozone and weathering.

EPDM is the material most commonly used in the rubber industry. Its use has now reached a stage of maturity, and leading producers such as ExxonMobil and Lanxess are expanding their production capacities. The main regions where the material is used are North America and Europe, where there are stricter environmental regulations and a strong focus on sustainable building. In these regions, the main applications of EPDM are weatherproofing in cars, roofs and electrical insulators. Continuing trends such as sustainable building and innovations in the manufacturing process, such as the use of high-pressure polymerization, are helping to ensure the vitality of EPDM in many industries.

Future Outlook

The EPDM market is expected to grow at a CAGR of 4.06% from 2024 to 2035. This growth is driven by the increasing demand for EPDM in various applications, especially in the automobile and construction industries, where its superior weather resistance and flexibility are highly appreciated. In addition, as electric vehicles gain popularity, the need for lightweight, durable materials will continue to drive EPDM consumption, and the penetration rate of EPDM in the automobile industry is expected to increase by about 16% in 2035.

The EPDM market will be shaped by the key technological developments and government regulations. In the long run, the development of more efficient polymerization techniques will increase the quality and lower the cost of EPDM, thus making it available to a wider range of industries. Also, the stricter the government regulations, the more sustainable the materials will be, including EPDM. The development of smart materials and the increasing emphasis on the circular economy will also have a major influence on the EPDM market, which will play an increasingly important role in the future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 4.7Billion Billion |

| Growth Rate | 5.15% (2023-2032) |

Ethylene Propylene Diene Monomer Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.