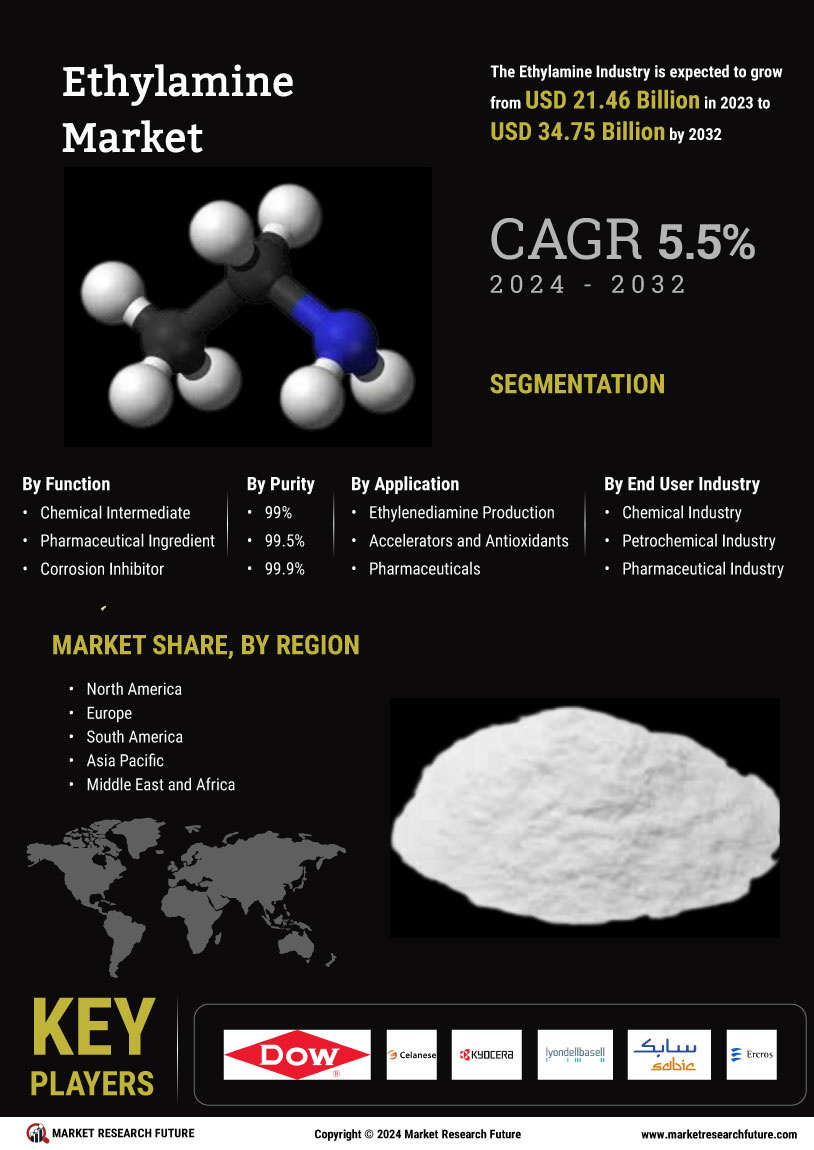

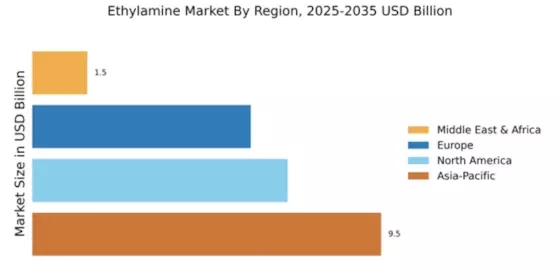

Market Growth Projections

The Global Ethylamine Market Industry is projected to experience substantial growth over the next decade. The market value is expected to rise from 23.9 USD Billion in 2024 to 43.1 USD Billion by 2035, indicating a robust expansion driven by various sectors, including agrochemicals, pharmaceuticals, and personal care. The compound annual growth rate of 5.52% from 2025 to 2035 reflects the increasing applications and demand for ethylamine across diverse industries. This growth is likely to attract investments and encourage further research and development, positioning the ethylamine market as a key player in the global chemical industry.

Growing Demand in Agrochemicals

The Global Ethylamine Market Industry is experiencing a notable surge in demand from the agrochemical sector. Ethylamine Market is utilized as a key intermediate in the production of herbicides, pesticides, and fungicides, which are essential for enhancing agricultural productivity. As the global population continues to rise, the need for efficient agricultural practices becomes increasingly critical. This trend is reflected in the projected market value of 23.9 USD Billion in 2024, with expectations to reach 43.1 USD Billion by 2035. The compound annual growth rate of 5.52% from 2025 to 2035 indicates a robust growth trajectory driven by the agrochemical industry's expansion.

Advancements in Chemical Manufacturing

The Global Ethylamine Market Industry benefits from advancements in chemical manufacturing processes. Innovations in production techniques, such as more efficient catalytic processes and greener synthesis methods, are enhancing the yield and purity of ethylamine. These advancements not only reduce production costs but also align with global sustainability initiatives, appealing to environmentally conscious consumers and businesses. As manufacturers adopt these modern techniques, the market is expected to grow, contributing to the projected increase in market value from 23.9 USD Billion in 2024 to 43.1 USD Billion by 2035. This evolution in manufacturing practices may also lead to a more competitive landscape within the industry.

Rising Applications in Pharmaceuticals

The Global Ethylamine Market Industry is significantly influenced by its applications in the pharmaceutical sector. Ethylamine Market serves as a building block for various pharmaceutical compounds, including antihistamines and antidepressants. The increasing prevalence of chronic diseases and mental health disorders globally has led to a heightened demand for effective medications. This trend is likely to bolster the market, as pharmaceutical companies seek to innovate and expand their product lines. The anticipated growth in the pharmaceutical sector, coupled with the projected market value increase to 43.1 USD Billion by 2035, underscores the importance of ethylamine in drug development and production.

Market Dynamics and Competitive Landscape

The Global Ethylamine Market Industry is characterized by dynamic market conditions and a competitive landscape. Various players are actively engaged in strategic partnerships, mergers, and acquisitions to enhance their market presence and expand product offerings. This competitive environment fosters innovation and drives improvements in product quality and availability. As companies strive to differentiate themselves, the market is expected to benefit from enhanced product diversity and improved customer satisfaction. The anticipated growth trajectory, with a CAGR of 5.52% from 2025 to 2035, suggests that the competitive dynamics will play a crucial role in shaping the future of the ethylamine market.

Increasing Demand from Personal Care Products

The Global Ethylamine Market Industry is witnessing a rising demand from the personal care and cosmetics sector. Ethylamine Market is utilized in the formulation of various personal care products, including hair dyes, skin care items, and fragrances. As consumer preferences shift towards high-quality and innovative personal care solutions, manufacturers are increasingly incorporating ethylamine-based ingredients to enhance product performance. This trend is likely to drive market growth, contributing to the overall increase in market value projected to reach 43.1 USD Billion by 2035. The personal care industry's expansion reflects broader consumer trends towards self-care and wellness, further solidifying ethylamine's role in this market.