Market Share

Introduction: Navigating the Competitive Landscape of the eSIM Market

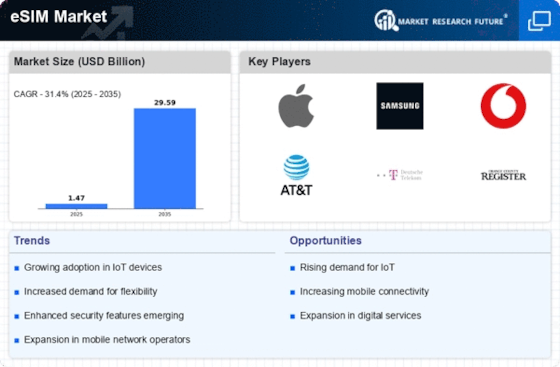

eSIM market is gaining momentum, resulting from the accelerating rate of technological development, the emergence of regulatory frameworks and the growing expectations of consumers. The leading players, including equipment manufacturers, IT systems integrators and network operators, are all pursuing leadership in the market by introducing new and innovative solutions, such as artificial intelligence (AI)-based data analysis and IoT integration, which enhance both the end-user experience and operational efficiency. Equipment manufacturers are focusing on integrating eSIM technology into their devices, while IT systems integrators are developing platforms that allow eSIM devices to be managed and deployed. And network operators are investing in green technology to meet the demands of the digital economy, and thereby positioning themselves as responsible partners in the digital economy. Towards 2024–2025, the most promising regions are those in Asia–Pacific and Europe, where strategic deployment trends are matched by favourable regulations and consumers’ readiness for advanced communication solutions.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions encompassing eSIM management and integration with telecom services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Deutsche Telekom AG | Strong telecom network integration | eSIM management services | Europe, Asia |

| NTT Docomo Inc. | Leading telecom operator in Japan | eSIM solutions for mobile services | Japan, Asia |

Specialized Technology Vendors

These vendors focus on the development of eSIM technology and secure elements for mobile devices.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| STMicroelectronics | Advanced semiconductor technology | eSIM chipsets | Global |

| Infineon Technologies AG | Expertise in security solutions | Secure eSIM solutions | Global |

| NXP Semiconductors | Innovative secure connectivity solutions | eSIM and secure elements | Global |

Security and Identity Management

These vendors specialize in digital security and identity management solutions for eSIM applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Gemalto NV | Strong focus on digital security | eSIM security and management | Global |

Emerging Players & Regional Champions

- The eSIMs of Airalo can be used in any country where there is an eSIM. They have recently teamed up with several telecommunications operators to broaden their range of products and services, and they now compete with the traditional SIM card companies by providing a more convenient and cost-effective solution for travellers.

- The Truphone group is a UK-based eSIM specialist with a recent contract in the smart device and automotive sectors. Their technology complements the offerings of the established carriers by offering flexible data plans and a wide range of countries. This gives them a strong position in the enterprise market.

- GIGSky (USA): specializes in eSIM data plans for travelers and IoT devices. Recent implementations include smart devices and wearables. They are a direct challenge to established telcos with their highly competitive prices and easy access to data services in many countries.

- eSIM solutions for IoT applications, especially in the automotive and smart city sectors. With recent partnerships with the leading car manufacturers, the company has expanded its market presence, complementing its existing telecommunications services with tailored IoT solutions.

Regional Trends: In 2022, the eSIM market was booming in Europe and North America. Its popularity was driven by a boom in IoT applications and consumer devices. The increasing trend towards digitalization and remote connections led to an increase in demand for eSIMs, particularly among travellers and companies looking for flexible data plans. A number of regional champions were emerging in specific niche markets, such as IoT and travel, which were putting the established telecommunications operators to the test with their innovations and their user-friendly solutions.

Collaborations & M&A Movements

- Vodafone and Thales partnered in 2022 to enhance eSIM technology for IoT devices, aiming to strengthen their competitive positioning in the growing IoT market.

- Apple acquired the eSIM technology company, eSIMGo, in 2022 to bolster its capabilities in mobile connectivity and improve user experience across its devices.

- Deutsche Telekom and Gemalto entered a collaboration to develop secure eSIM solutions for automotive applications, addressing the increasing demand for connected vehicles.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | Gemalto, IDEMIA | Several of the world's largest airports have benefited from the installation of Gemalto's self-boarding solutions. They have facilitated the flow of passengers and reduced waiting times. The IDEMIA technology is used in several international airports, proving its reliability and effectiveness in the field. |

| AI-Powered Ops Mgmt | Cisco, IBM | The ai-based management tools of Cisco are being used by many airlines to optimize their resource allocation and increase their efficiency. The ai-based systems of IBM have been integrated into airport systems to predict the behavior of passengers, thereby improving the service quality. |

| Border Control | Thales, Secunet | Thales has installed, in several countries, advanced border control equipment using the eSIM technology to verify identity. Secunet’s systems are known for their high security standards and have been successfully used by European border control agencies. |

| Sustainability | Vodafone, Orange | In recent years, eSIM has been gaining in popularity. It is the integration of eSIM into the product range that demonstrates Orange’s commitment to the environment. |

| Passenger Experience | Samsung, Apple | And as a result, passengers will enjoy a smooth and uninterrupted connection. eSIM is a key feature of the latest generation of Apple devices. It provides users with easy access to multiple networks, enhancing the overall convenience of their travel. |

Conclusion: Navigating the eSIM Competitive Landscape

In 2022, the eSIM market will be highly competitive and highly fragmented. The players in the market will include both the established telecommunications operators and the new entrants. In terms of regions, the trend towards eSIM is mainly driven by North America and Europe, where governments are driving the trend through regulatory support and consumers are demanding flexibility. Consequently, vendors must strategically position themselves in terms of eSIM by focusing on the development of new capabilities, such as AI for improved customer experience, automation for increased efficiency, and the use of sustainable business practices to meet the changing expectations of consumers. These capabilities will help the vendors to provide flexible solutions and to shape the future of the market.

Leave a Comment