Growing Investment in Biotechnology

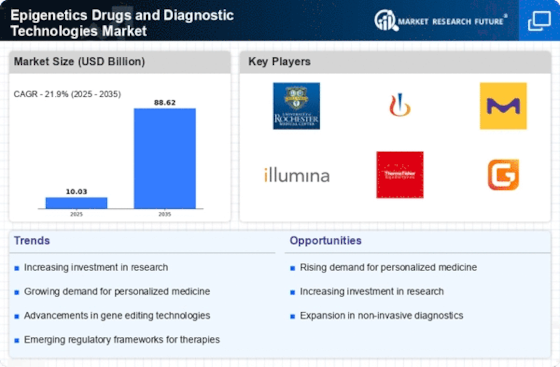

The surge in investment within the biotechnology sector is a notable driver for the Epigenetics Drugs and Diagnostic Technologies Market. Venture capital funding and government grants are increasingly directed towards research and development in epigenetics, reflecting a heightened interest in this field. In recent years, funding for epigenetic research has seen a substantial increase, with estimates suggesting that investments could exceed $10 billion by 2026. This influx of capital is likely to accelerate the development of novel epigenetic drugs and advanced diagnostic technologies. As more companies enter the market, competition will intensify, potentially leading to innovative solutions that address unmet medical needs, thereby enhancing the overall market landscape.

Rising Demand for Personalized Medicine

The growing emphasis on personalized medicine is reshaping the Epigenetics Drugs and Diagnostic Technologies Market. Patients increasingly seek treatments tailored to their unique genetic and epigenetic profiles, which necessitates the development of targeted therapies. This trend is supported by Market Research Future indicating that the personalized medicine market is projected to reach $2.5 trillion by 2028. Epigenetic drugs, which can modify gene expression without altering the DNA sequence, are particularly well-suited for personalized approaches. Additionally, diagnostic technologies that can accurately assess an individual's epigenetic landscape are essential for guiding treatment decisions. As healthcare systems continue to prioritize personalized care, the demand for epigenetic solutions is expected to rise, driving market growth.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders appears to be a primary driver for the Epigenetics Drugs and Diagnostic Technologies Market. As these diseases often involve complex genetic and epigenetic interactions, there is a growing demand for innovative therapeutic solutions. According to recent estimates, the prevalence of cancer is projected to reach approximately 29.5 million cases by 2040, necessitating advanced treatment options. This trend underscores the need for epigenetic drugs that can target specific pathways involved in disease progression. Furthermore, diagnostic technologies that can accurately assess epigenetic modifications are becoming increasingly essential for early detection and personalized treatment strategies, thereby propelling market growth.

Regulatory Support for Epigenetic Innovations

Regulatory bodies are increasingly recognizing the potential of epigenetic therapies, which serves as a significant driver for the Epigenetics Drugs and Diagnostic Technologies Market. Initiatives aimed at expediting the approval process for innovative therapies are being implemented, encouraging pharmaceutical companies to invest in epigenetic research. For instance, the FDA has established programs to facilitate the development of breakthrough therapies, which include epigenetic drugs. This regulatory support is likely to enhance the market's attractiveness, as companies can bring their products to market more efficiently. Furthermore, as regulatory frameworks evolve to accommodate new technologies, the landscape for epigenetic diagnostics is also expected to improve, fostering innovation and expanding market opportunities.

Technological Advancements in Epigenetic Research

Technological innovations in epigenetic research are significantly influencing the Epigenetics Drugs and Diagnostic Technologies Market. The development of next-generation sequencing (NGS) and CRISPR-based technologies has revolutionized the ability to study epigenetic modifications at an unprecedented scale. These advancements facilitate the identification of novel drug targets and biomarkers, which are crucial for the development of effective epigenetic therapies. Market data indicates that the NGS market is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years, reflecting the increasing reliance on these technologies in epigenetic research. As researchers continue to uncover the complexities of epigenetic regulation, the demand for sophisticated diagnostic tools and targeted therapies is likely to expand, further driving market dynamics.