North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Environmental Sensor Equipment MRO Services Market, holding a significant market share of $2.75B in 2025. The region's growth is driven by stringent environmental regulations, increasing investments in smart infrastructure, and a rising demand for advanced monitoring solutions. The regulatory landscape encourages innovation and compliance, further propelling market expansion.

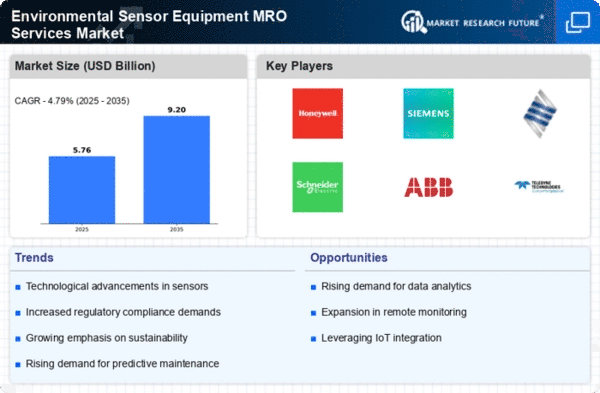

The United States and Canada are the leading countries in this sector, with major players like Honeywell, Emerson, and Teledyne Technologies driving competition. The presence of established companies fosters a robust ecosystem for technological advancements and service offerings. As the market evolves, partnerships and collaborations among key players are expected to enhance service delivery and customer satisfaction.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing demand for Environmental Sensor Equipment MRO Services, with a market size of $1.5B projected for 2025. The region's growth is supported by stringent environmental policies and a commitment to sustainability. The European Union's Green Deal and various national regulations are catalysts for investment in environmental monitoring technologies, driving market expansion and innovation.

Germany, France, and the UK are at the forefront of this market, with key players like Siemens and Schneider Electric leading the charge. The competitive landscape is characterized by a mix of established firms and innovative startups, fostering a dynamic environment for growth. As the market matures, collaboration among stakeholders will be crucial for addressing emerging challenges and enhancing service offerings.

Asia-Pacific : Rapidly Growing Market Segment

Asia-Pacific is emerging as a significant player in the Environmental Sensor Equipment MRO Services Market, with a projected size of $1.2B by 2025. The region's growth is fueled by rapid industrialization, urbanization, and increasing environmental awareness. Governments are implementing stricter regulations to monitor air and water quality, which is driving demand for advanced sensor technologies and maintenance services.

Countries like Japan, China, and India are leading the charge, with companies such as Yokogawa Electric and Ametek establishing a strong presence. The competitive landscape is evolving, with both local and international players vying for market share. As the region continues to develop, investment in R&D and technological innovation will be key to sustaining growth and meeting regulatory requirements.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is currently the smallest market for Environmental Sensor Equipment MRO Services, with a size of $0.05B projected for 2025. The slow growth can be attributed to limited infrastructure development and varying regulatory frameworks across countries. However, increasing awareness of environmental issues and the need for compliance with international standards are beginning to drive demand for sensor technologies and maintenance services.

Countries like South Africa and the UAE are showing potential for growth, with investments in environmental monitoring systems. The competitive landscape is still developing, with few key players present. As the region seeks to enhance its environmental policies, opportunities for growth in the MRO services market may arise, particularly in urban areas.