North America : Market Leader in Services

North America holds a commanding position in the Environmental Engineering and Consulting Services Market, with a market size of $32.5 billion in 2025. The region's growth is driven by stringent environmental regulations, increasing public awareness of sustainability, and significant investments in infrastructure. Demand for innovative solutions to combat climate change and enhance environmental compliance is on the rise, further propelling market expansion.

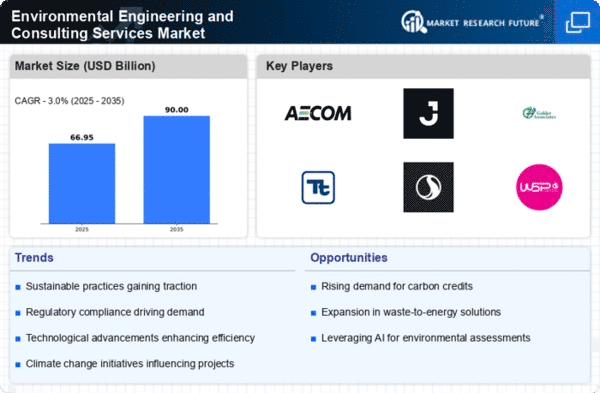

The competitive landscape is characterized by major players such as AECOM, Jacobs, and Tetra Tech, which dominate the market. The U.S. is the leading country, accounting for a substantial share of the market, while Canada also plays a significant role. The presence of these key players fosters innovation and enhances service offerings, ensuring that North America remains at the forefront of environmental consulting services.

Europe : Sustainable Development Focus

Europe's Environmental Engineering and Consulting Services Market is projected to reach $18.0 billion by 2025, driven by a strong commitment to sustainability and environmental protection. The European Union's Green Deal and various national regulations are key catalysts for growth, promoting investments in renewable energy and waste management. The increasing focus on reducing carbon footprints and enhancing biodiversity is shaping demand trends across the region.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring firms like Arcadis and Ramboll. These countries are investing heavily in innovative technologies and sustainable practices, positioning themselves as leaders in environmental consulting. The presence of established players ensures a robust market environment, fostering collaboration and knowledge sharing among stakeholders.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the Environmental Engineering and Consulting Services Market, projected to reach $10.5 billion by 2025. This growth is fueled by rapid urbanization, industrialization, and increasing environmental awareness among the populace. Governments are implementing stricter regulations to address pollution and promote sustainable practices, creating a favorable environment for market expansion.

Countries like China, India, and Japan are leading the charge, with a competitive landscape that includes both local and international players. The presence of firms such as Golder Associates and Tetra Tech highlights the region's potential. As these countries invest in infrastructure and environmental protection, the demand for consulting services is expected to rise, making Asia-Pacific a key player in the global market.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is gradually emerging in the Environmental Engineering and Consulting Services Market, with a projected size of $4.0 billion by 2025. The growth is driven by increasing awareness of environmental issues, coupled with government initiatives aimed at sustainable development. Countries are focusing on diversifying their economies and investing in green technologies, which is expected to boost demand for consulting services in the region.

Leading countries such as South Africa and the UAE are making strides in environmental management, with a competitive landscape that includes both local firms and international players. The presence of key players like SNC-Lavalin and Environmental Resources Management is indicative of the region's potential. As investments in environmental projects increase, the market is poised for significant growth in the coming years.