Expansion of 5G Technology

The rollout of 5G technology is poised to significantly impact the Enterprise Network Equipment Market. With its promise of ultra-fast data speeds and low latency, 5G enables enterprises to enhance their connectivity capabilities. This technology is expected to facilitate the deployment of advanced applications such as augmented reality, virtual reality, and real-time data analytics. As businesses seek to leverage these capabilities, the demand for compatible network equipment is likely to surge. Market analysts suggest that the 5G infrastructure investment could reach trillions of dollars in the coming years, further driving the growth of the Enterprise Network Equipment Market. The transition to 5G not only transforms communication but also compels enterprises to upgrade their network equipment to remain competitive.

Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is a key driver for the Enterprise Network Equipment Market. As organizations increasingly integrate IoT solutions into their operations, the demand for robust network infrastructure rises. This trend is evidenced by the projected increase in connected devices, which is expected to reach over 30 billion by 2030. Consequently, enterprises require advanced networking equipment to manage the influx of data generated by these devices. The need for reliable connectivity and low latency further emphasizes the importance of investing in high-performance network equipment. This growing adoption of IoT not only enhances operational efficiency but also necessitates the evolution of the Enterprise Network Equipment Market to accommodate the unique requirements of IoT applications.

Increased Focus on Cybersecurity

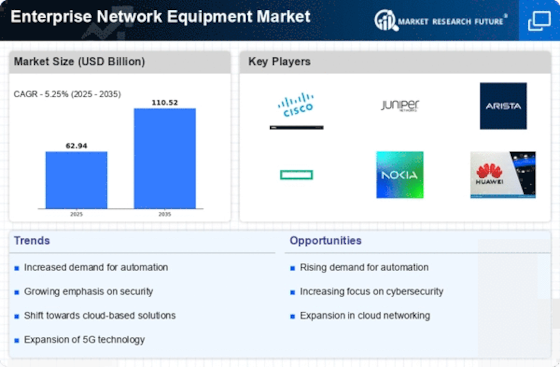

As cyber threats become more sophisticated, the emphasis on cybersecurity within the Enterprise Network Equipment Market intensifies. Organizations are increasingly aware of the potential risks associated with inadequate network security, leading to a surge in demand for equipment that incorporates advanced security features. This trend is reflected in the market, where the cybersecurity segment is projected to grow at a compound annual growth rate of over 10% through the next five years. Enterprises are investing in network equipment that offers integrated security solutions, such as firewalls and intrusion detection systems, to safeguard their data and infrastructure. This heightened focus on cybersecurity not only protects sensitive information but also drives innovation within the Enterprise Network Equipment Market, as manufacturers strive to meet evolving security requirements.

Rising Demand for High-Speed Connectivity

The increasing reliance on data-intensive applications is driving the demand for high-speed connectivity within the Enterprise Network Equipment Market. As businesses adopt cloud computing, big data analytics, and video conferencing solutions, the need for faster and more reliable network infrastructure becomes paramount. Market data indicates that the demand for high-speed internet connections is expected to grow by over 25% in the next few years. This trend compels enterprises to invest in advanced networking equipment capable of supporting high bandwidth and low latency. The shift towards high-speed connectivity not only enhances productivity but also fosters innovation, as organizations can leverage new technologies and services. Consequently, the Enterprise Network Equipment Market is likely to experience substantial growth as it adapts to these evolving connectivity demands.

Emergence of Software-Defined Networking (SDN)

The emergence of Software-Defined Networking (SDN) is transforming the landscape of the Enterprise Network Equipment Market. SDN allows for greater flexibility and control over network resources, enabling organizations to optimize their network performance. This technology facilitates the centralization of network management, which can lead to cost savings and improved operational efficiency. As enterprises increasingly adopt SDN solutions, the demand for compatible network equipment is expected to rise. Market analysts predict that the SDN market will grow significantly, with a compound annual growth rate exceeding 20% over the next several years. This shift towards SDN not only enhances network agility but also drives innovation within the Enterprise Network Equipment Market, as vendors develop new solutions to meet the changing needs of businesses.