Engineering Resins Size

Engineering Resins Market Growth Projections and Opportunities

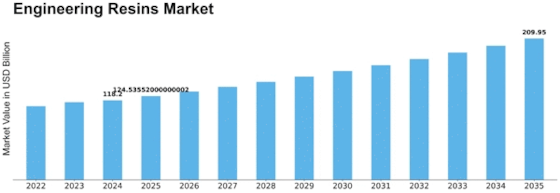

Numerous market factors significantly influence the dynamics of the Engineering Resins Market. The demand for lightweight materials in industries such as automotive, aerospace, and electronics is one of the major drivers of this market. These sectors prioritize engineering resins with a high strength-to-weight ratio because they make it easy to reduce products' overall weight without compromising on performance. In 2022, Engineering Resins Market Size was estimated at USD 109.57 Billion (GMI). The Engineering Resin industry is expected to touch a high point of about USD 179.40 billion by 2032, up from about USD 112.18 billion in 2023, representing a compound annual growth rate (CAGR) of about 5.36%. In addition, technological advancement can be termed as one of the key factors that shape the dynamics of the Engineering Resins Market. Ongoing research and development efforts in polymer science led to innovative formulations involving engineering resins with improved mechanical strength, heat resistance, and chemical resistance, amongst other properties. Besides, the growing trend towards employing additive manufacturing in production processes has also affected this sector. This is mostly due to their compatibility with 3D printing technologies, hence making engineering resins most preferable for use in additive manufacturing. This results in the fabrication of complex and customized components while increasing demand for high-performance resins that can meet specific requirements associated with the process. Furthermore, the geographic location of the main players, as well as manufacturing facilities, affects the way that the Engineering Resins Market operates. Proximity between production units and final consumers reduces transport costs and time thus possessing vital significance within market competitiveness. Additionally; there are disruptions within supply chains and availability issues regarding raw materials, which greatly affect the Engineering Resins Market. In addition, this field is highly regulated. Otherwise, the presence or absence of such regulations greatly influences various types of substances used across different applications. Apart from these two just-mentioned factors, there exist other reasons that alter the entire situation on the market all the time. The industry is characterized by a mix of established and emerging players, with mergers, acquisitions, and partnerships shaping the competitive scenario. Market consolidation also leads to a highly competitive environment where firms strive to gain a competitive advantage through research and development investments, expanding product portfolios, and global distribution networks.

Leave a Comment