Research Methodology on Endoprosthesis Market

Introduction

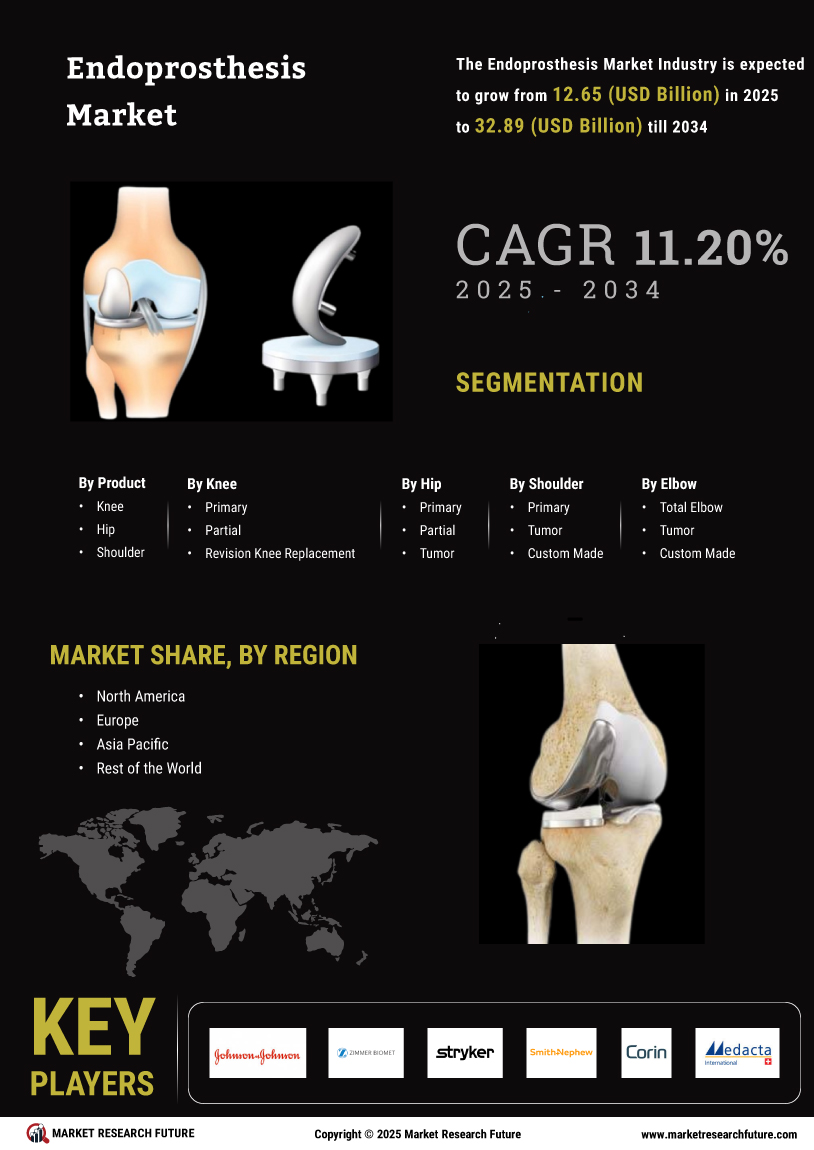

Endoprosthesis is a type of medical device implant made of metal components, ceramic components, and polymers, inserted into the body to replace a missing joint or body part. Endoprosthesis offers an attractive alternative to traditional orthopaedic surgical methods and has recently become popular among medical practitioners due to its ability to restore function and improve quality of life. The global endoprosthesis market is set to experience healthy growth due to the large ageing population, increasing incidence of obesity-related conditions, increasing adoption of sports activities, and advances in healthcare technologies.

Research Methodology

A comprehensive research methodology for the market research report on the global endoprosthesis market has been employed to gain an in-depth understanding of the market. The primary and secondary sources of information used in the market research report include manufacturer data, industry reports, publications, news sources, government databases, and online research databases such as PubMed, LexisNexis, Google Scholar, etc.

1. Primary Research:

This includes research conducted with the help of interviews, surveys, focus groups, questionnaires, and user feedback. Primary research participants included professionals, end-users, and industry experts from the medical device industry who have an in-depth understanding of the endoprosthesis market.

In order to gain a better insight into the market, the respondents were asked questions such as:

-What are the major drivers for the growth of the global endoprosthesis market?

-What are the common challenges faced by the industry?

-What are the latest trends in the global endoprosthesis market?

-What are the emerging applications of endoprosthesis?

-What kind of new products have been developed in the past few years?

2. Secondary Research:

Secondary research was conducted to gain an in-depth understanding of the competitive landscape, regional market trends, and global economic conditions. The following sources of information were used:

-Industry reports from leading companies

-White papers from industry experts

-Government and trade association databases

-Financial reports

-Media and business journals

The secondary research was conducted to understand the past and present conditions of the market, to find out what the future trends in the market will be, and to map the market landscape of the global endoprosthesis market.

3. Market Size Estimation:

For estimating the market size of the global endoprosthesis market, two approaches were used - the top-down approach and the bottom-up approach. In the top-down approach, data from the key market players in the industry was gathered and the total market size was determined accordingly. While in the bottom-up approach, the total market size was estimated by adding up the revenues of all the segment players in the industry.

4. Data Triangulation:

Data triangulation was employed to capture the market trends and accurately represent the market size. The data collected through primary and secondary research was triangulated to obtain an accurate representation of the total global endoprosthesis market.

5. Market Breakdown & Data Verification:

In order to gain an in-depth understanding of the market, the data and information gathered through primary and secondary research were then validated through an in-depth analysis of the market trends in various regions. The report was then segmented based on the major product types, applications, technologies, end-users, and regions.

6. Modelling & Forecasting:

The report was then further modelled and forecasted to gain an understanding of the future growth prospects of the global endoprosthesis market. The market size estimations were created by using multiple sets of variables such as population growth rate, product price developments, changes in cost structure, market dynamics, technological advances, market-related risk factors, future product launches, and market share.

7. List of Participants:

The participants in the research report included end-users, medical device industry representatives, business solution providers, government and regulatory bodies, technology vendors, system integrators, technology providers, and other related players.

Conclusion

The research methodology employed in the market research report aims to provide an in-depth understanding of the global endoprosthesis market. A comprehensive primary and secondary research process was used to gather data from potential sources and verify the accuracy of the data. Market size estimation and forecasting were completed using both top-down and bottom-up approaches. Data triangulation and market breakdown were also used to obtain an accurate representation of the market.