Growing Emphasis on Data Security

In the End-user Computing Market (EUC) Market, the growing emphasis on data security is a critical driver. Organizations are increasingly aware of the risks associated with data breaches and cyber threats, prompting them to invest in advanced security measures. The market for EUC solutions is projected to expand as companies seek to implement secure access controls, encryption, and multi-factor authentication. According to recent data, nearly 70% of organizations prioritize security in their EUC strategies, indicating a shift towards more secure computing environments. This focus on security not only protects sensitive information but also ensures compliance with regulatory requirements, further driving the demand for EUC solutions. As a result, the End-user Computing Market (EUC) Market is likely to witness innovations in security technologies, enhancing the overall resilience of computing environments.

Shift Towards Hybrid Work Environments

The shift towards hybrid work environments is a pivotal driver in the End-user Computing Market (EUC) Market. As organizations adopt a blend of in-office and remote work, the demand for flexible EUC solutions that cater to diverse work settings is increasing. This trend is supported by data indicating that over 60% of companies are implementing hybrid work models, necessitating the development of technologies that facilitate seamless collaboration and communication. The need for solutions that can support both on-premises and remote access is driving investments in cloud computing and virtualization technologies. Consequently, the End-user Computing Market (EUC) Market is likely to see a rise in demand for integrated platforms that enhance connectivity and productivity across various work environments.

Increased Demand for Remote Work Solutions

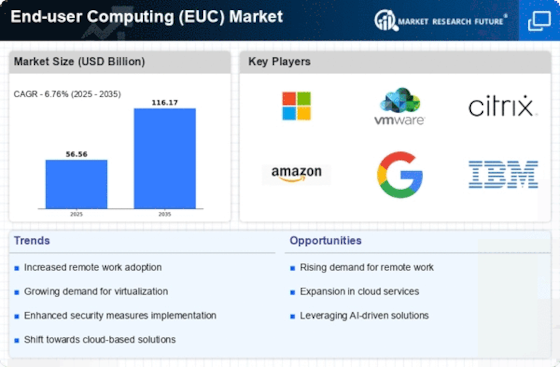

The End-user Computing Market (EUC) Market experiences a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for robust EUC solutions becomes paramount. This shift is evidenced by a projected growth rate of approximately 12% annually in the EUC sector, driven by the necessity for employees to access applications and data securely from various locations. Companies are investing in virtual desktop infrastructure (VDI) and cloud-based applications to facilitate seamless remote access. This trend not only enhances productivity but also fosters employee satisfaction, as workers appreciate the flexibility to work from home or other locations. Consequently, the End-user Computing Market (EUC) Market is likely to continue evolving to meet these demands, with innovations aimed at improving user experience and security in remote environments.

Adoption of Mobile Devices and Applications

The End-user Computing Market (EUC) Market is significantly influenced by the widespread adoption of mobile devices and applications. As smartphones and tablets become integral to daily business operations, organizations are increasingly seeking EUC solutions that support mobile access to applications and data. This trend is reflected in the growing market share of mobile device management (MDM) solutions, which are projected to grow by over 15% in the coming years. The ability to access corporate resources on-the-go enhances employee productivity and collaboration, making it a vital component of modern business strategies. Furthermore, the integration of mobile applications into EUC frameworks allows for greater flexibility and responsiveness to market demands. Consequently, the End-user Computing Market (EUC) Market is likely to continue evolving to accommodate the needs of a mobile workforce.

Emergence of Artificial Intelligence in EUC Solutions

The integration of artificial intelligence (AI) into End-user Computing Market (EUC) solutions is emerging as a transformative driver within the industry. AI technologies are being utilized to enhance user experience, automate routine tasks, and improve decision-making processes. The market for AI-driven EUC solutions is expected to grow substantially, with estimates suggesting a compound annual growth rate of around 20% over the next few years. Organizations are leveraging AI to analyze user behavior, optimize resource allocation, and provide personalized support. This not only streamlines operations but also empowers employees to focus on higher-value tasks. As AI continues to advance, the End-user Computing Market (EUC) Market is likely to witness a proliferation of innovative solutions that harness the power of machine learning and data analytics.