- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

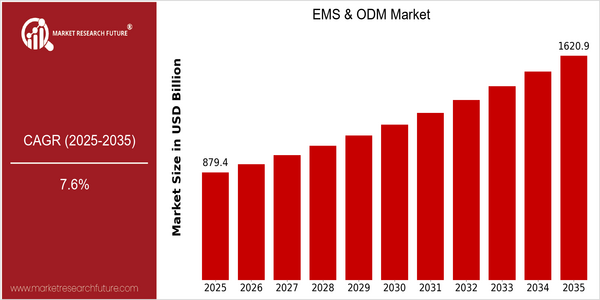

| Year | Value |

|---|---|

| 2025 | USD 879.39 Billion |

| 2035 | USD 1620.9 Billion |

| CAGR (2025-2035) | 7.6 % |

Note – Market size depicts the revenue generated over the financial year

The EMS and ODM market is growing rapidly, with a current market size of $879.39 billion in 2025 and a projected growth of $1620.9 billion by 2035. The compound annual growth rate (CAGR) of this industry is expected to be 7.6%. The trend of the era of smart phones and other smart terminals is to outsource the manufacturing process, and the trend of the era is to outsource the manufacturing process. The EMS and ODM industry is booming, and it is also a trend of the era. In the pursuit of efficiency and cost reduction, the reliance of companies on EMS and ODM is increasing, and the innovation and speed of new products are accelerated. The industry is also driven by the rapid development of automation, artificial intelligence, and the Internet of Things. These new technologies not only increase the efficiency of the production process, but also allow the manufacturer to provide more solutions for the needs of the market. The major companies in this industry, such as Foxconn, Jabil, and GE, are actively investing in advanced manufacturing technology and forming strategic alliances to increase their competitiveness. Foxconn's recent investment in artificial intelligence-driven manufacturing systems is a good example of this trend. It is expected to meet the needs of the market and become the industry leader.

Regional Market Size

Regional Deep Dive

The EMS and ODM market is characterized by the rapid technological development and the rising demand for specialized electronic products from different industries. In North America, the market is driven by a strong focus on innovation, especially in the automotive, medical and consumer electronics industries. The region benefits from a strong supply chain and skilled workforce that enhances its competitiveness. Furthermore, the increasing trend towards outsourcing to reduce costs and increase efficiency is reshaping the market.

Europe

- The European Union's Green Deal is pushing manufacturers towards sustainable practices, prompting EMS and ODM providers to innovate in eco-friendly materials and processes, with companies like Siemens leading the charge.

- Brexit has created a shift in supply chain dynamics, with many companies reevaluating their manufacturing locations and partnerships, leading to increased collaboration among European firms to maintain competitiveness.

Asia Pacific

- China continues to dominate the EMS and ODM market, with companies like Foxconn and Pegatron investing heavily in automation and smart manufacturing technologies to enhance productivity.

- The rise of the Internet of Things (IoT) is driving demand for connected devices, prompting EMS and ODM providers in the region to develop specialized solutions tailored to various industries, including healthcare and smart home applications.

Latin America

- Countries like Mexico are becoming attractive destinations for EMS and ODM services due to their proximity to the U.S. market, with companies like Sanmina expanding their operations to leverage this advantage.

- The region is experiencing a growing trend towards nearshoring, as businesses seek to reduce supply chain risks and costs, prompting local governments to implement incentives for foreign investment in manufacturing.

North America

- The rise of electric vehicles (EVs) has led to significant investments in EMS and ODM services, with companies like Flex and Jabil expanding their capabilities to meet the demand for advanced automotive electronics.

- Regulatory changes aimed at enhancing supply chain transparency and sustainability are influencing the market, with organizations such as the U.S. Department of Commerce promoting initiatives that encourage local sourcing and manufacturing.

Middle East And Africa

- The Middle East is witnessing a surge in technology adoption, with governments like the UAE's pushing for diversification away from oil dependency, leading to increased investments in electronics manufacturing.

- Regulatory frameworks are evolving, with initiatives aimed at fostering local manufacturing capabilities, such as Saudi Arabia's Vision 2030, which encourages partnerships with global EMS and ODM players.

Did You Know?

“Approximately 70% of all electronic devices are manufactured in Asia, with China alone accounting for over 30% of global electronics production.” — International Data Corporation (IDC)

Segmental Market Size

The EMS and ODM segments of the market are crucial to the development of the overall electronics industry, which is currently experiencing a steady rise in demand as consumers increasingly look for specialized products. This has led to a growing need for faster prototyping and shorter product life cycles, as well as the development of automation and smart manufacturing. EMS and ODM companies like Foxconn and Flex are putting these trends to good use, expanding their service offerings to meet these needs. In fact, EMS and ODM services have already been adopted by a large number of industries, including consumer electronics, automobiles, and health care. ODM companies are particularly important to the development of the automobile industry, as they are responsible for the assembly of a large number of components used in electric cars. For example, ODM companies like Tsinghua have a large number of automobile parts to manufacture, and they are also responsible for assembling many of the components used in the production of electric cars. Also driving the growth of EMS and ODM services are macro-level trends such as the move towards sustainable development and the localization of production, which are helping to reduce the carbon footprint of products and increase the resilience of supply chains. In addition, the development of IoT and AI is having a positive effect on the segment, enabling it to design smarter and more flexible products.

Future Outlook

During the period from 2025 to 2035, the EMS and ODM market is expected to grow at a CAGR of 7.6%. The growth will be driven by the rapid development of the Internet of Things, smart home, and digital transformation in various industries. In addition, as the speed of product development and time to market continues to accelerate, companies will continue to rely on EMS and ODM service providers, and the penetration rate will increase, especially in emerging economies where manufacturing capabilities are rapidly improving. Meanwhile, technological advances such as automation, artificial intelligence-driven smart manufacturing, and sustainable production will have a significant impact on the future development of the EMS and ODM market. Industry 4.0 is expected to further improve efficiency and quality, and help manufacturers meet the growing demand for customized, high-quality products. Furthermore, the development of green manufacturing will be driven by the implementation of national policies on sustainable development, which will also drive the development of the EMS and ODM market. By 2035, the EMS and ODM market is expected to grow in value and scale, and will become an important link in the global supply chain.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 541.9 Billion |

| Market Size Value In 2023 | USD 588.611 Billion |

| Growth Rate | 8.62% (2023-2032) |

EMS ODM Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.