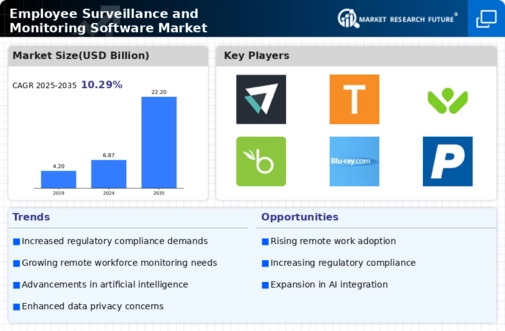

Focus on Employee Productivity

The ongoing emphasis on enhancing employee productivity is a significant factor driving the Employee Surveillance and Monitoring Software Market. Organizations are increasingly utilizing monitoring software to assess performance metrics and identify areas for improvement. By leveraging these tools, companies can gain insights into employee workflows, time management, and overall efficiency. Recent studies indicate that organizations implementing surveillance solutions have reported productivity increases of up to 20%. This trend suggests that the demand for employee monitoring software will continue to rise as businesses seek to optimize their workforce. Consequently, the Employee Surveillance and Monitoring Software Market is poised for growth as companies prioritize productivity enhancement.

Increased Remote Work Adoption

The rise in remote work arrangements has propelled the Employee Surveillance and Monitoring Software Market. Organizations are increasingly adopting these solutions to ensure productivity and accountability among remote employees. According to recent data, approximately 30% of the workforce is now working remotely, necessitating robust monitoring tools. This shift has led to a surge in demand for software that can track employee performance, time management, and engagement levels. As companies seek to maintain operational efficiency, the integration of surveillance software becomes essential. The Employee Surveillance and Monitoring Software Market is thus experiencing growth driven by the need for effective oversight in a remote work environment.

Enhanced Data Security Concerns

With the increasing frequency of data breaches and cyber threats, organizations are prioritizing data security, which significantly influences the Employee Surveillance and Monitoring Software Market. Companies are investing in monitoring solutions that not only track employee activities but also safeguard sensitive information. The market is projected to grow as businesses recognize the importance of protecting their data assets. In fact, a recent report indicates that nearly 60% of organizations have experienced a data breach in the past year, highlighting the urgent need for comprehensive surveillance tools. Consequently, the demand for employee monitoring software that includes security features is likely to rise, further propelling the Employee Surveillance and Monitoring Software Market.

Regulatory Compliance Requirements

The evolving landscape of regulatory compliance is a critical driver for the Employee Surveillance and Monitoring Software Market. Organizations are increasingly required to adhere to various regulations concerning employee monitoring and data protection. Compliance with laws such as GDPR and CCPA necessitates the implementation of monitoring solutions that ensure transparency and accountability. As companies strive to avoid hefty fines and legal repercussions, the demand for surveillance software that facilitates compliance is expected to grow. Recent statistics suggest that non-compliance can result in penalties exceeding millions of dollars, underscoring the importance of investing in effective monitoring tools. Thus, the Employee Surveillance and Monitoring Software Market is likely to expand as businesses seek to navigate complex regulatory frameworks.

Technological Advancements in Monitoring Solutions

The rapid advancement of technology is reshaping the Employee Surveillance and Monitoring Software Market. Innovations such as artificial intelligence, machine learning, and real-time analytics are enhancing the capabilities of monitoring solutions. These technologies enable organizations to gather and analyze vast amounts of data, providing deeper insights into employee behavior and performance. As businesses increasingly recognize the value of data-driven decision-making, the demand for sophisticated surveillance software is likely to grow. Recent market analyses indicate that the integration of advanced technologies could lead to a market expansion of over 15% in the coming years. Thus, the Employee Surveillance and Monitoring Software Market is expected to thrive as organizations adopt cutting-edge monitoring solutions.