Aging Population

An aging population is a critical driver of the Global Emollient Market Industry, as older individuals often experience drier skin and related conditions. This demographic shift necessitates the use of emollients to maintain skin hydration and overall health. With the global population aged 60 and above projected to reach 2.1 billion by 2050, the demand for emollient products is likely to escalate. Manufacturers are responding by developing specialized formulations targeting the unique needs of mature skin, which may include enhanced moisturizing properties and anti-aging benefits. This trend underscores the importance of emollients in promoting skin health across various age groups.

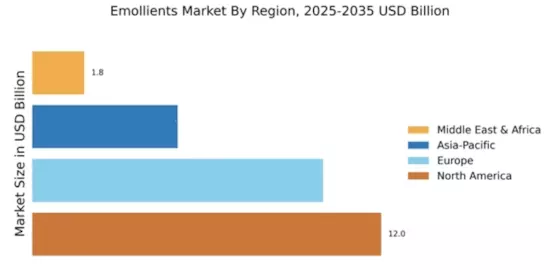

Market Growth Projections

The Global Emollient Market Industry is poised for substantial growth, with projections indicating a market value of 28.8 USD Billion in 2024 and an anticipated increase to 42.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 3.48% from 2025 to 2035. Such projections reflect the increasing integration of emollients in various sectors, including personal care, pharmaceuticals, and cosmetics. The expanding applications of emollients, coupled with rising consumer awareness about skin health, are likely to drive this growth, making it a dynamic segment within the broader personal care market.

Growth of E-commerce Platforms

The rise of e-commerce platforms significantly impacts the Global Emollient Market Industry by providing consumers with greater access to a diverse range of emollient products. Online shopping offers convenience and the ability to compare products easily, which is particularly appealing to younger consumers. As e-commerce continues to expand, it is anticipated that the market will benefit from increased sales and visibility. This trend is likely to contribute to a compound annual growth rate of 3.48% from 2025 to 2035, as more consumers turn to online channels for their skincare needs. Retailers are also leveraging digital marketing strategies to engage consumers and drive sales.

Innovation in Product Formulations

Innovation in product formulations is a key driver of the Global Emollient Market Industry, as manufacturers continuously seek to enhance the efficacy and appeal of their offerings. This includes the development of multifunctional emollients that not only moisturize but also provide additional benefits such as sun protection or anti-aging properties. The introduction of new delivery systems and sustainable packaging further attracts environmentally conscious consumers. As the market evolves, these innovations are likely to play a pivotal role in differentiating products and capturing consumer interest, thereby sustaining growth in an increasingly competitive landscape.

Rising Demand for Skin Care Products

The Global Emollient Market Industry experiences a notable increase in demand for skin care products, driven by growing consumer awareness regarding skin health and aesthetics. As individuals prioritize personal care, the market is projected to reach 28.8 USD Billion in 2024. This surge is particularly evident in regions with high disposable incomes, where consumers are willing to invest in premium skincare formulations that incorporate emollients. The trend towards natural and organic ingredients further propels this demand, as consumers seek products that not only enhance skin appearance but also provide therapeutic benefits. Consequently, manufacturers are innovating to meet these evolving consumer preferences.

Increase in Dermatological Conditions

The prevalence of dermatological conditions such as eczema and psoriasis significantly influences the Global Emollient Market Industry. As awareness of these conditions rises, there is a corresponding increase in the demand for emollient-based treatments. The market is expected to grow steadily, with a projected value of 42.0 USD Billion by 2035. This growth is likely attributed to the rising incidence of skin disorders, particularly in urban areas where environmental factors exacerbate skin issues. Healthcare professionals increasingly recommend emollients as essential components of treatment regimens, thereby expanding their usage beyond cosmetic applications to therapeutic ones.