Market Growth Projections

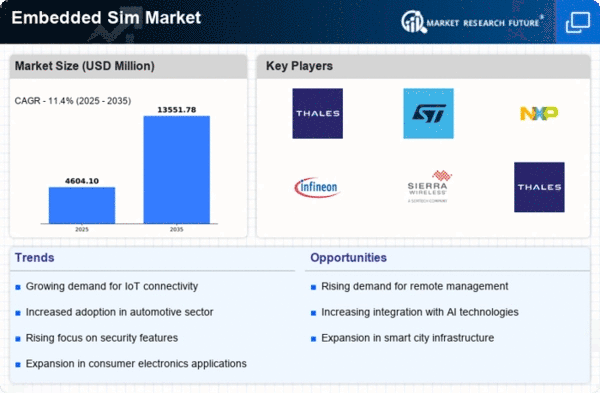

The Global Embedded SIM Market Industry is poised for substantial growth, with projections indicating a market value of 4.13 USD Billion in 2024 and an anticipated increase to 13.6 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 11.41% from 2025 to 2035. The increasing adoption of IoT devices, enhanced security features, and the expansion of the automotive sector are key factors contributing to this upward trend. As organizations and consumers alike recognize the benefits of embedded SIM technology, the market is likely to experience robust expansion in the coming years.

Enhanced Security Features

Security concerns surrounding mobile connectivity are increasingly influencing the Global Embedded SIM Market Industry. Embedded SIMs provide advanced security features, such as secure authentication and encryption, which are essential for protecting sensitive data transmitted over mobile networks. This is particularly relevant in sectors like finance and healthcare, where data breaches can have severe consequences. The ability to remotely manage and update security credentials further enhances the appeal of embedded SIM technology. As organizations prioritize data security, the demand for embedded SIMs is likely to rise, contributing to the anticipated growth of the market to 13.6 USD Billion by 2035.

Growth in Automotive Sector

The automotive sector's transition towards connected vehicles is a crucial factor propelling the Global Embedded SIM Market Industry. With the rise of electric and autonomous vehicles, embedded SIMs play a pivotal role in enabling vehicle-to-everything communication, enhancing safety, and providing real-time data analytics. Automotive manufacturers are increasingly integrating embedded SIM technology to facilitate features such as navigation, infotainment, and remote diagnostics. This integration is expected to drive substantial growth in the market, as the automotive industry continues to innovate and prioritize connectivity solutions.

Rising Demand for IoT Devices

The increasing proliferation of Internet of Things devices is a primary driver for the Global Embedded SIM Market Industry. As more devices become interconnected, the need for seamless connectivity solutions intensifies. Embedded SIM technology facilitates remote provisioning and management of mobile subscriptions, which is crucial for IoT applications. For instance, smart meters, connected vehicles, and industrial automation systems rely heavily on reliable connectivity. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 4.13 USD Billion in 2024, underscoring the importance of embedded SIMs in supporting the expanding IoT ecosystem.

Government Initiatives and Regulations

Government initiatives aimed at promoting digital transformation and connectivity are significantly influencing the Global Embedded SIM Market Industry. Various countries are implementing regulations that encourage the adoption of embedded SIM technology in sectors such as telecommunications and transportation. These initiatives often focus on enhancing infrastructure and ensuring secure communication channels. For example, regulatory frameworks that support the deployment of smart city solutions and connected public transport systems are likely to boost the demand for embedded SIMs. Such government support is expected to create a conducive environment for market growth, aligning with the overall trend towards digitalization.

Support for Multiple Network Operators

The flexibility offered by embedded SIM technology to support multiple network operators is a significant driver for the Global Embedded SIM Market Industry. This capability allows users to switch between different mobile network providers without needing to physically change SIM cards. Such convenience is particularly beneficial for travelers and businesses operating in multiple regions. As global connectivity becomes increasingly vital, the ability to manage multiple subscriptions through a single embedded SIM is likely to enhance user experience and drive market growth. This trend aligns with the projected compound annual growth rate of 11.41% from 2025 to 2035.