Growth of Industrial Automation

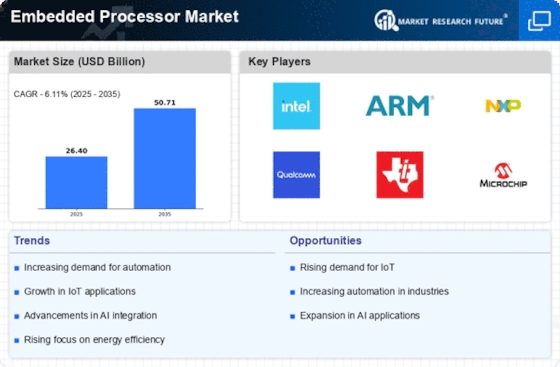

The Embedded Processor Market is poised for growth due to the increasing emphasis on industrial automation across various sectors. As industries strive to enhance productivity and efficiency, the demand for embedded processors that can support automation technologies is on the rise. Recent statistics indicate that the industrial automation market is expected to grow at a CAGR of around 10% over the next few years. This growth is likely to drive the need for advanced embedded processors capable of handling real-time data processing and control tasks. The integration of these processors into manufacturing equipment, robotics, and control systems is expected to revolutionize operations, thereby creating substantial opportunities for the Embedded Processor Market.

Rising Focus on Energy Efficiency

The Embedded Processor Market is increasingly shaped by a rising focus on energy efficiency, as both consumers and industries seek to reduce energy consumption. Embedded processors are being designed with energy-saving features that allow devices to operate more efficiently, which is particularly crucial in battery-powered applications. Market analysis suggests that energy-efficient embedded processors could account for a significant portion of the market, with projections indicating a growth rate of approximately 15% in this segment. This trend is likely to encourage manufacturers to innovate and develop processors that not only meet performance requirements but also adhere to stringent energy regulations. As sustainability becomes a priority, the Embedded Processor Market is expected to adapt and thrive in this evolving landscape.

Surge in Demand for Smart Devices

The Embedded Processor Market is experiencing a notable surge in demand for smart devices, driven by the increasing adoption of Internet of Things (IoT) technologies. As consumers and businesses alike seek to enhance connectivity and automation, the need for efficient embedded processors becomes paramount. According to recent data, the market for smart devices is projected to grow at a compound annual growth rate (CAGR) of approximately 20% over the next five years. This growth is likely to propel the Embedded Processor Market, as manufacturers strive to develop processors that can handle complex tasks while maintaining low power consumption. The integration of embedded processors in smart home devices, wearables, and industrial automation systems is expected to further stimulate market expansion, indicating a robust future for the industry.

Advancements in Automotive Technology

The Embedded Processor Market is significantly influenced by advancements in automotive technology, particularly with the rise of electric and autonomous vehicles. These vehicles require sophisticated embedded processors to manage various functions, including navigation, safety systems, and infotainment. The automotive sector is projected to invest heavily in embedded systems, with estimates suggesting that the market for automotive embedded processors could reach USD 10 billion by 2026. This investment reflects a growing trend towards integrating advanced computing capabilities into vehicles, thereby enhancing performance and safety. As automotive manufacturers increasingly prioritize smart technologies, the Embedded Processor Market is likely to benefit from this shift, positioning itself as a critical component in the evolution of modern transportation.

Integration of AI and Machine Learning

The Embedded Processor Market is witnessing a transformative shift with the integration of artificial intelligence (AI) and machine learning technologies. These advancements enable embedded processors to perform complex computations and data analysis at the edge, reducing latency and enhancing performance. The market for AI-enabled embedded processors is anticipated to grow significantly, with estimates suggesting a CAGR of around 25% over the next few years. This growth is driven by the increasing demand for smart applications in sectors such as healthcare, automotive, and consumer electronics. As industries continue to leverage AI for improved decision-making and automation, the Embedded Processor Market is likely to see a surge in innovation and investment, positioning itself at the forefront of technological advancement.